Fast Cables Limited plans expansion with IPO funds

Overview

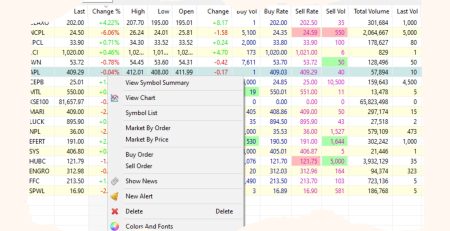

Fast Cables Limited, a leading manufacturer of electrical cables and conductors in Pakistan, is set to issue 128 million ordinary shares in an initial public offering (IPO) with a floor price of Rs. 23.5 per share. The company aims to utilize the proceeds primarily for infrastructure development and loan repayments.

IPO Issue Size

The IPO will allocate 75% of shares to successful bidders and 25% to retail investors. The maximum ceiling price is set at Rs. 32.9 per share.

Purpose of Issue

Fast Cables intends to enhance its infrastructure by constructing new buildings and installing new machinery to expand production capacity. A significant portion of the funds will be used for loan repayments related to building and machinery imports.

📢 Announcement: We're on WhatsApp – Join Us There!

Here's what you get:

- Member-Only Discussion Community

- Research Reports with Explanations & Expert Views

- Access to Exclusive KSEStocks Market Reports

- Model Portfolio with Clear Investment Rationale

- Monthly Portfolio Review & Health Check

- On-Demand Stock Coverage Requests

- PSX Facilitation (CDC Account, Share Transfer, Physical Conversion)

Current and Post-Expansion Capacities

| Capacity Metrics | Current (June ’23) | Post-Expansion |

|---|---|---|

| Copper (M-tons) | 8,400 | 12,000 |

| Aluminium (M-tons) | 13,800 | 17,800 |

| Total (M-tons) | 22,200 | 29,800 |

The expansion plan targets a 43% increase in copper production and a 23% increase in aluminum production.

Future Demand Prospects

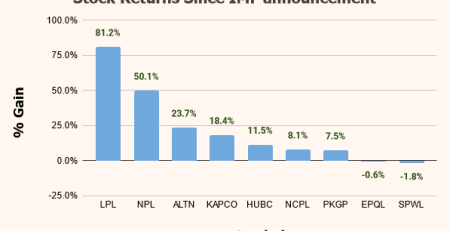

Fast Cables anticipates rising demand for its products due to government initiatives to boost solar infrastructure and energy capacity. Additionally, growth in the construction sector and ongoing power infrastructure projects are expected to drive sales.

Major Cost Breakdown

| Cost Category | Percentage Share |

|---|---|

| Plant and Machinery | 39.39% |

| Land | 30.15% |

| Building Construction (acquired land) | 15.07% |

| Duties and others (Plant and Machinery) | 9.85% |

| Installation and erection (Plant) | 4.80% |

Customer Base and Products

Fast Cables operates through B2C, B2B, and B2G models, supplying a range of electrical products including low voltage cables, medium voltage cables, and conductors. The company’s revenue is primarily derived from the low voltage segment.

Don't miss:

- Which cars are driving the rally in auto stocks?

- Is DGKC going to Rs. 240?

- Why TPLP could go higher.

Financial Highlights

The company has demonstrated strong financial performance, with a 5-year revenue CAGR of 43%. Gross profit has grown at a 5-year CAGR of 52%, reflecting the company’s robust growth trajectory.

Key Risks

Fast Cables faces risks such as negative cash flow, elevated raw material costs, economic slowdown, and increasing competition.

Disclaimer:

The information in this article is based on research by Darson Research. All efforts have been made to ensure the data represented in this article is as per the research report. This report should not be considered investment advice. Readers are encouraged to consult a qualified financial advisor before making any investment decisions.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comment (1)

Please if you could share POST IPO “lock in” period for fast cable’s insiders?