10 factors to consider when evaluating company management

Perhaps the most ignored segment of any person’s research of a particular stock is the quality of its management. People tend to forget that a business is only as good as the quality of the people running it. Hand over a perfectly fine business to incompetent people and they will run it into the ground. Evaluating management is important.

In my search for finding companies with the best management, I came across 10 different criteria for evaluating management that can be applied to any company’s management to see if there are any red flags.

Here we go.

📢 Announcement: We're on WhatsApp – Join Us There!

Here's what you get:

- Member-Only Discussion Community

- Research Reports with Explanations & Expert Views

- Access to Exclusive KSEStocks Market Reports

- Model Portfolio with Clear Investment Rationale

- Monthly Portfolio Review & Health Check

- On-Demand Stock Coverage Requests

- PSX Facilitation (CDC Account, Share Transfer, Physical Conversion)

Payouts

Payouts are the most exciting part of an earnings announcement for any shareholder. But they can be tricky when it comes to judging a company’s management.

As a shareholder, you want to get as much money paid out as possible so that you get your initial investment out of the business quickly. But growing businesses like to reinvest the earnings back into the business.

As a dividend investor, you need to find companies that strike a balance between payouts and growth. The only time you want a company to payout 100% of its earnings is when the company is in a business with guaranteed income.

Don't miss:

- Which cars are driving the rally in auto stocks?

- Is DGKC going to Rs. 240?

- Why TPLP could go higher.

Typically, companies that offer exclusive services to the government fall into this category. Their growth is limited, but their profits are guaranteed. So they payout everything they earn.

A good payout ratio generally falls between 30% to 60%, depending on the type of business.

Drawing large salaries/luxurious lifestyle

Be on the lookout for the compensation packages of the upper management. As long as the business is growing and performing well, high salaries can be justified. But if a business is struggling and you see the management enjoying all the perks, question them.

An example of this is the former CEO of Home Depot(HD:US) Robert Nardelli. He was taking home a salary of $7 million in cash and $30 million in restricted stock award. Meanwhile, the company wasn’t doing all that well.

When he couldn’t take the criticism anymore, he took a severance package of $210 million and left.

None of the above benefitted the shareholders of the company.

The same is the case with companies where the management leads a luxurious lifestyle. It’s a red flag.

The best examples of this are Harvey Weinstein and Elizabeth Holmes. Both were known for their lavish and luxurious lifestyles and both ended up ruining themselves and their businesses.

Diluting equity

Ideally, a company should be able to earn enough that it can cover its own expenses. But sometimes that doesn’t happen and it needs to raise cash. There are many ways to do that. And the sale of new shares is one of them.

It is neither good nor bad for the shareholder. But if you’re the shareholder of such a company, your percentage ownership of the company is now reduced and there is a negative impact on the EPS too.

Personally, I don’t like investing in a business that wants to raise more money from the sale of stock.

Owner political affiliation

If the owners of a company have political affiliations, its governance decisions might at times be influenced by political events. Some companies tend to do good in times when the political party their management supports is in power.

That’s because they enjoy a friendly relationship with the regulators. And what’s more, they either have access to the policymakers who make policies that may directly affect their business or are themselves the policymakers too!

However, the same company can quickly go out of favour with regulators once the government changes. So the change in government is your risk when investing in such a business.

It may be a better idea to invest in companies where the owners aren’t vocal about their political affiliations. Or even better, don’t have any. Such companies are usually in the good books of the regulators and don’t get into much trouble.

Related party transactions

Related party transactions occur when a company spends money on one of its associated businesses rather than its primary business.

If a company starts spending too much money on a subsidiary instead of its main business, it could be a red flag.

Extraordinary auditor fees

Auditors are necessary to maintain the financial integrity of a company’s financial statements. And they sometimes charge hefty fees for that.

Be on the lookout for abnormally high auditor fees though.

Research shows that the earnings quality of a company is directly linked to its auditor fees. As the auditor fees increase, the quality of the company’s earnings decrease.

Another way to look at auditor fees is from the perspective of the company’s exposure to litigation.

If a company is paying high auditor fees, it might mean that its earnings are exposed to litigation. In that case, you as a shareholder should find out about that risk and only then invest in the company.

Other income greater than revenue

A good business should be able to generate most of its revenue from its main line of business. One would think that is quite obvious, but there are numerous examples where a company’s primary business doesn’t generate revenue and it is made up for by ‘other income’.

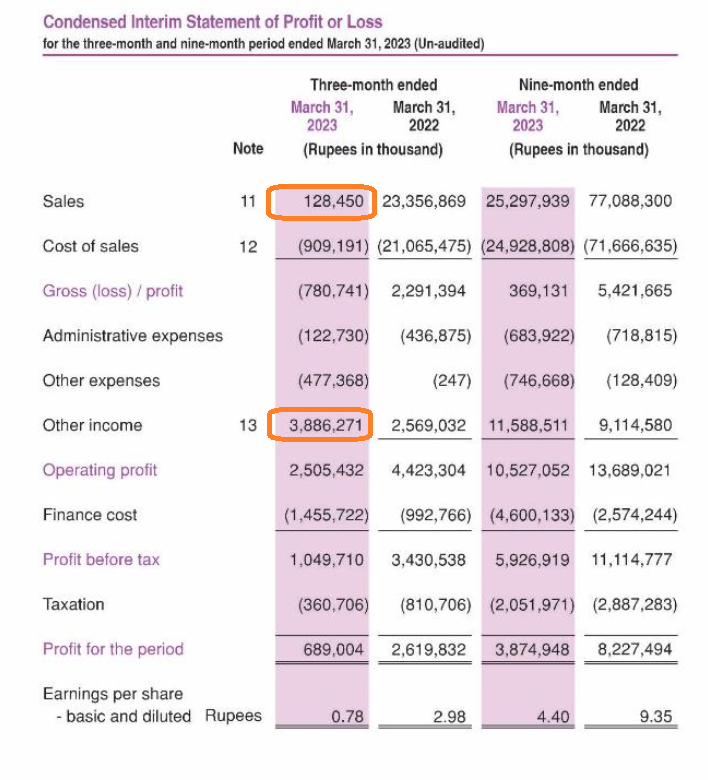

Here’s an example of a company that generated most of its income by means other than its primary business. This relates to KAPCO on the Pakistan Stock Exchange:

As you can see, in this quarterly report, the company generated Rs. 128 million in revenue from its primary business(power generation).

On the other hand, Rs. 3.88 billion were earned through other income!

In short, the company earned 30 times more from other sources compared to its primary business. Do you think the management deserves applause for this?

In KAPCO’s case, the other income is interest earned on its huge cash position. The main business is down as the power plant is old and isn’t efficient enough for the government to keep buying electricity from it.

It’s a dying business with a huge cash position. That’s all.

Treatment of Minority Shareholders

Good management always takes care of the interests of its minority shareholders. This could be in the form of dividends or bonuses.

There are many businesses that, despite earning record profits, do not pay out a single penny to their shareholders.

As a minority shareholder, dividends offer a form of security. If they aren’t there, you have to ask yourself the question, does the management really care about me as a shareholder?

Of course, not paying out dividends doesn’t necessarily mean the management is bad. The company could be reinvesting the money in its own business. But most long-term shareholders prefer dividends and therefore payouts act as a filter where they filter out minority shareholder-friendly management.

Taking a loan at above market interest rate from the promoter

If a loan is available for a lower interest in the market, and the company chooses to take money from a promoter at a higher interest rate, it is highly unlikely that the management has good intentions. Run away from such a company as fast as you can.

Frequent changes in auditors

If a company is changing auditors too often, it might be a sign that its books aren’t in order. Sometimes auditors refuse to work with companies that manipulate their numbers or portray them in an unethical way.

But you’ll have to dig a little deeper to know if the change in auditor was indeed because of bad management.

That’s because companies can change their auditors for a number of reasons that aren’t necessarily negative.

Required by law

Sometimes the country that a company operates in requires it to change its auditors every few years. In that case, management has no choice but to oblige with the local laws.

Compromised auditors

In some cases, an auditor’s independence is compromised or there is a conflict of interest. Good management will replace such an auditor in order to ensure the integrity of its financial statements.

Get fresh eyes on their numbers

Some companies also like to change their auditors every few years to get ‘fresh eyes’ on their numbers.

Having said that, if the change is too frequent, it could be a red flag that something fishy is going on. As an investor, it is your responsibility to investigate whether a company is changing its auditors for good or bad reasons.

That’s all. If you know of any other criterion to filter out bad management, feel free to share in the comments.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (5)

How can i find out when the company last changed their Auditors?

Mohsin

Usually companies announce a change of auditor through a notification sent to the PSX data portal. But you can also read their quarterly/yearly reports and see if they changed their auditors.

You have written KAPCO’s other income as 2.88 billion whereas in the image it says 3.88 billion.

Thanks, I have corrected it.

Good read.