4 reasons why you should invest in REITs

Real Estate is the biggest asset class in Pakistan. Everyone has the basic idea how to look for good properties and how to purchase them. But not everyone has the capacity to differentiate between speculating the future value of a property and investing in a good property.

Real Estate Investment Trusts (REITs) are a modern way of investing in Real Estate. They function just like a few friends pooling in money to buy a property they couldn’t afford individually. Only this is more regulated and gives the individual investor not only more protection but also more liquidity.

Here are four reasons why I think everyone should make REITs a part of their investment portfolio.

📢 Announcement: We're on WhatsApp – Join Us There!

Here's what you get:

- Member-Only Discussion Community

- Research Reports with Explanations & Expert Views

- Access to Exclusive KSEStocks Market Reports

- Model Portfolio with Clear Investment Rationale

- Monthly Portfolio Review & Health Check

- On-Demand Stock Coverage Requests

- PSX Facilitation (CDC Account, Share Transfer, Physical Conversion)

1. No high-ticket investment needed

The biggest problem when investing in a good real estate project is that participants often don’t have enough funds to get involved.

For example, if you bought an apartment or a shop in a mall, you will need to spend a few million to acquire the property, pay its maintenance charges, work on its renovation repeatedly and also be on the lookout for tenants. This is quite a hassle.

So even if you were able to arrange the money, managing the property is in itself a big headache.

Don't miss:

- Which cars are driving the rally in auto stocks?

- Is DGKC going to Rs. 240?

- Why TPLP could go higher.

If the same mall had a REIT structure, you would be able to buy a stake in it even with a starting investment of Rs. 1000 by buying its stock on the stock exchange. You will receive the rent in the form of dividends, as most REITs pay out over 90% of their earnings.

One point to note with such an investment approach is that the value realization of the property depends on the stock market participants. While the property itself may double in value, the REIT units that trade on the market may take some time to catch up.

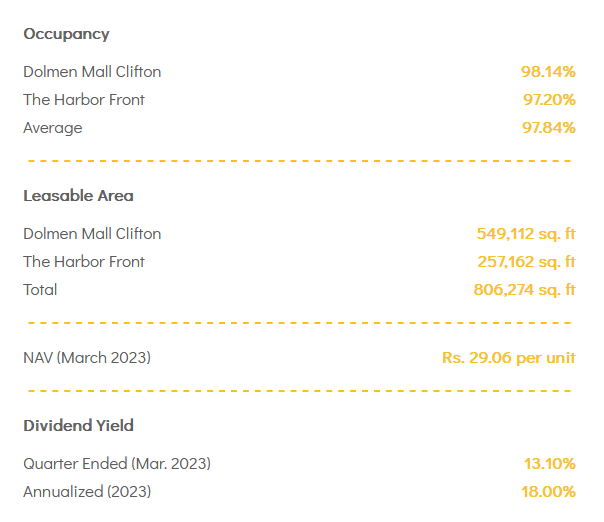

This is true in the case of Dolmen City REIT (DCR), where the DCR unit trades at around Rs. 14, which is about 50% of the actual per unit value of the Dolmen Mall and The Harbor Front Offices, the two properties that DCR owns.

One can look at it both as an advantage and a disadvantage. Depending on your risk tolerance and investing horizon, you could be buying the property at a 50% discount!

2. Liquid nature

Another problem with Real Estate investment is its illiquid nature.

Let’s say you buy a plot in a housing society and it doubles in value. Great! But how do you get your hands on that value? You can’t sell a piece of that land. You have to sell the whole plot to cash it in. And when you do that, you don’t hold the asset anymore.

So while you’ve made a good profit, you must liquidate your whole investment to realize that profit.

In the case of REITs, you can book profit on a small portion of your investment by selling the units on the stock exchange. As an example, the Global Residency REIT (GRR) sells at Rs. 13.52 per unit(as of 30/04/2024).

There is of course the other possibility that you can keep gaining from your property by renting it out and don’t necessarily have to sell. But even that isn’t an attractive option as I point out in the next section.

3. Good and stable returns

In Pakistan, rental yield stays at about 4-6%. This means that if you own a property worth 1 crore and rent it out at a rental yield of 5%, you will receive around 5 lac per year(Rs. 41666 per month).

Even in a high-interest rate environment as we have now, where interest rates are at 22%, the rental yield doesn’t change.

Compare that to DCR. It also has a similar rental yield. However, because the value of its REIT units is determined by the stock market participants, it is trading at 50% of its nav(net asset value).

As you can see in the above image, the March 2023 nav stood at Rs. 29.06 per unit while the unit was trading on the market at around Rs. 13.5.

Even today, the price of DCR is in the same range.

Effectively, you’re getting a rental yield of around 15% if you buy its unit from the stock market!

4. Diversification of tenants

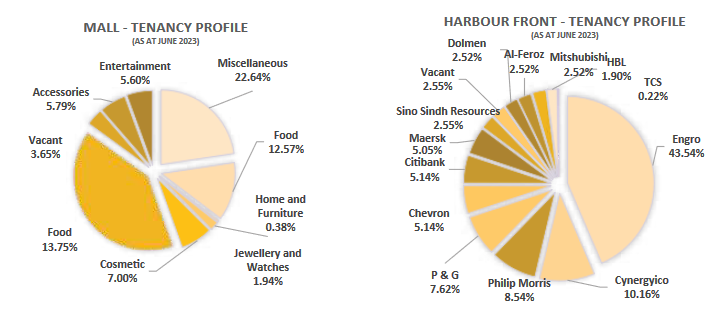

Whereas you can only rent out your apartment to one party, a REIT-based property can be rented out to multiple tenants. These tenants usually have good financial health and you do not have to worry about them paying rent.

Take a look at the tenancy profile of DCR for example:

Moreover, if these tenants ever decide to leave, there are usually enough parties lined up to take over the space.

So why do people still prefer to buy property instead of REITs?

If REITs are so attractive, why do people still prefer to buy property the old-fashioned way?

The answer is simple: lack of awareness and fear of the unknown.

The public in our country does not usually analyze investments. The best they do is study the neighbourhood and the prospects of the area in which they are buying the property. Some would call this speculation instead of investment.

Another reason is the fear of the capital markets. People consider stock market a gambling activity whereas the rest of the world considers it a medium of wealth generation. This is why we have such a low investor base. People simply don’t trust the markets.

The third reason is the issue of taxation. Capital markets are highly regulated and one would need to be a filer to make the best use of them. Real Estate investors often have an unregistered source of income and investing it into the stock market becomes a hurdle, as they would eventually need to disclose the source of the money.

All in all, the safety and diversification provided by REITs make it an attractive addition to any investor’s portfolio.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (3)

Thanks bhai

DCR is a gem in psx