Why dividends cause share price drop if they’re paid from earnings?

When a dividend is paid, the share price drops by approximately the same amount because of a concept called the ex-dividend adjustment.

For many people, this concept is confusing. Some wonder why the dividend is deducted from the share price when it is paid from earnings. Others ask what’s the point of a dividend if the same amount is deducted from the total value of their investment.

Due to this confusion, investors often overlook dividend stocks and opt for more risky and volatile scrips where they can book capital gains to ‘secure’ their profits. However, this involves market timing and often causes investors to lose money.

So let’s try to understand the concept of ex-dividend and see why it is beneficial for investors even though the share price falls by the same amount.

Dividend is a Redistribution of Earnings

Dividends are paid out of a company’s earnings. They do not ‘come’ from the share price.

But what is share price? What does it reflect? It reflects the total value of a company, as perceived by investors(also called valuation).

When a dividend is paid out from the earnings of the company, the company’s assets decrease. As a result, its total equity value decreases.

Since the company now has reduced assets and as a result a lower equity value, the market cannot give it the same price as before the dividend. Therefore, the share price drops by the dividend amount to reflect the new equity value.

Market Pricing Adjusts for the Cash Outflow

Before the ex-dividend date, the stock price reflects the value of the company, including the upcoming dividend.

On the ex-dividend date, since new buyers are no longer entitled to receive the dividend, the stock price is adjusted downward by the dividend amount.

This adjustment ensures fairness between those who buy or sell shares around the dividend payment.

For example, let’s say EFERT priced at Rs. 202 announces a Rs. 10 dividend. Someone who buys the stock before the ex-dividend date will receive this dividend. Anyone who buys after the ex-dividend date will NOT receive this dividend. So why would investors still want to pay Rs. 202 for the stock?

The answer is they wouldn’t want to pay Rs. 202 because they know that Rs. 10 per share has already left the company’s books. So a good approximation would be that the company is now worth Rs. 192(Rs. 202 minus Rs. 10).

Share Price vs. Total Return

Many investors think that when the share price drops on the ex-dividend date, they lose money. But the drop in share price doesn’t mean a loss for investors.

They receive the dividend amount as cash, so the total return (price + dividend) remains constant, assuming all other factors stay the same.

Investors should ALWAYS look at the total return of the stock, not just its share price.

Let’s understand this with an example.

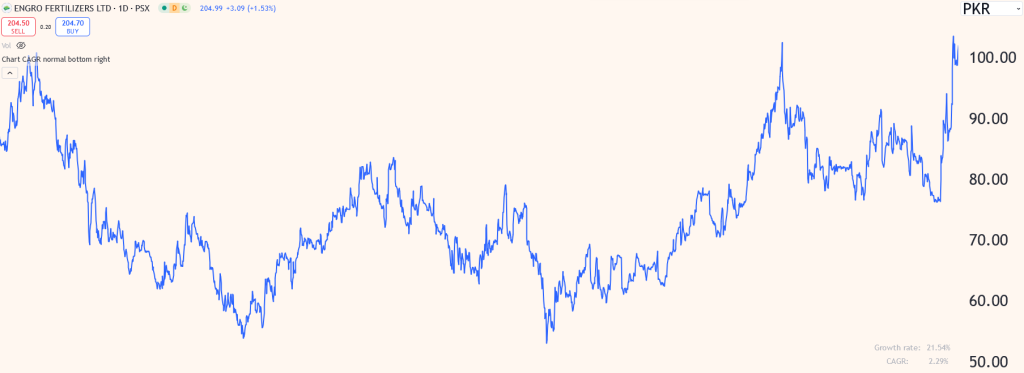

Here is a chart of EFERT from May 2015 to December 2023. The chart only reflects the share price during this period.

In 2015, the price was at Rs. 86 while in 2023 it was at Rs. 100. Many people make the mistake of assuming that this stock only gave Rs. 14 in profit, a CAGR of just over 2%. The reason for this is the ex-dividend phenomenon, which reduces the share price after each dividend.

But the reality is much different. Investors should look at adjusted data to determine the total returns of a stock. Here is the same chart adjusted for dividends:

The total return shows a completely different picture. Starting from a price of Rs. 19, the stock is now at Rs. 100. A pretty good picture, isn’t it? It reflects a CAGR of over 21%, which is an amazing return.

EFERT pays out regular dividends and every time it pays out the dividend, the stock price drops by the same amount. This is just a market mechanism and investors should not consider it a loss.

Next time you’re confused about why dividend stocks move slowly, this is the reason. Their price keeps reflecting a lower business value, but the value is already in your pocket in the form of dividends!

Comments (4)

Ex-price is just a mechanism, we receive the equivalent amount in cash dividend. People who think dividends don’t make a difference don’t understand how investing works.

Who is eligible for dividend or bonus amount ??

For today I have invest in stock abc and day after tomorrow abc announce dividend, in this case did I eligible for this dividend??

Or

Please confirm rule of above ??

Dividend payment depends on the ex-date. If you already hold the stock on market open on ex-date, you will get the dividend. The ex-date is announced in the same announcement where dividend is announced(They usually write the Book Closure date, and ex-date is Book Closure Date minus two working days).

Thank you so much for simple explanation