Pakistan’s Privatization Drive Gains Momentum

A Renewed Push for Economic Reform

Pakistan is rebooting its long-stalled privatization program in 2024–2025, a central component of a broader economic reform agenda supported by the International Monetary Fund (IMF). The primary motivation for this renewed drive is to reduce the significant fiscal burden caused by loss-making state-owned enterprises (SOEs).

The scale of the problem is substantial. SOEs collectively posted PkR342bn in losses during the first half of fiscal year 2025, while authorities provided PkR1.4tn in subsidies during fiscal year 2024, most of which were directed at these state-run firms. To counter this drain on public finances, the government has set an ambitious target to raise PkR87bn (~US$300mn) in privatization proceeds during fiscal year 2026, the largest such increase in decades.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

The IMF’s Role and the Government’s Commitment

Revitalizing the privatization agenda is a cornerstone of Pakistan’s US$7.0bn IMF-backed reform program. Critically, the IMF has conditioned its support on Pakistan reducing its footprint in commercially unviable enterprises and improving its governance.

In response, the government has reactivated the Privatisation Commission and is actively engaging foreign investors, as seen during recent IMF-World Bank meetings. The administration has provided assurances that difficult but necessary decisions, from energy tariff adjustments to comprehensive tax overhauls, are being implemented to create a stable macroeconomic environment for these divestment efforts.

Key Transactions and Sectors

The government has structured its privatization plan into two distinct phases. Phase I covers the immediate 12 months, while Phase II outlines a longer-term agenda spanning the next 3 to 5 years.

Power Sector Leads the Charge

📢 Announcement: We're on WhatsApp – Join Us There!

The country’s ailing power distribution companies (DISCOs) are at the forefront of the privatization effort. The sell-off is planned as follows:

- Phase I:

Islamabad Electric Supply Company (IESCO)

Faisalabad Electric Supply Company (FESCO)

Gujranwala Electric Power Company (GEPCO). - Phase II:

Sukkur Electric Power Company (SEPCO)

Hyderabad Electric Supply Company (HESCO)

The primary goals are to cut the approximate 20% in transmission and distribution (T&D) losses and reduce the PkR1.2tn in annual subsidies allocated for the sector in fiscal year 2025. In preparation for the sales, significant governance improvements have been made, with 90% of DISCO board seats now occupied by private-sector professionals. This has already attracted tangible foreign interest, with Turkish energy firms reportedly vowing interest in the process and a Turkish advisory firm hired to manage the DISCO sales.

Landmark Deals Signal Momentum

Several high-profile transactions, positioned as critical signals of the government’s resolve, are building momentum for the broader agenda.

- Pakistan International Airlines (PIA): The government is advancing the divestment of the core aviation business of PIAC, targeting the sale of a 75% stake for PkR135bn to a domestic conglomerate. This aligns with the broader plan to offload 51–100% of the national carrier by December 2025.

- First Woman Bank Ltd (FWBL): An early success is anticipated with the majority stake sale of the bank, which is targeted for completion by October 2025 for US$14.6mn.

- House Building Finance Company (HBFC): The divestment of HBFC is planned for conclusion by mid-CY26 as part of wider banking sector reforms.

Expanding the Scope of Privatization

The program’s scope extends beyond these initial deals to include a wide range of state assets. Other sectors and entities on the agenda include:

- Stakes in energy firms like Oil & Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL), as well as state-owned refineries, with potential interest from Gulf investors.

- The revival of Pakistan Steel Mills (PSM) through a sell-off or a public-private partnership.

- Increased private sector involvement in the management of major airports.

- The leasing of public transport assets, including ports and rail services, to experienced operators.

Bolstering Investor Confidence with Supportive Policies

To ensure the success of these transactions and rebuild investor trust after past missteps, the government is implementing a suite of supportive policies designed to address historical challenges related to bureaucracy and transparency.

- A Fast-Track Mechanism: A one-window platform has been established through the Special Investment Facilitation Council (SIFC) to cut bureaucratic hurdles and accelerate transactions.

- Commitment to Transparency: The government is emphasizing competitive and transparent bidding processes. To dispel concerns, high-profile auctions, such as the one for PIA, are set to be televised live.

- A More Business-Friendly Environment: The finance ministry has taken over tax policy functions and introduced simpler tax filing procedures, signaling a move toward a more predictable policy environment.

- Improved Financial Disclosure: Under the SOE Act 2023, state-owned enterprises are transitioning to International Financial Reporting Standards (IFRS) by CY26. This will enhance financial disclosure and simplify due diligence for potential investors.

The Broader Investment Outlook

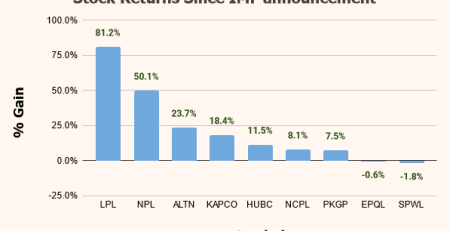

This privatization drive is a key factor underpinning a bullish outlook for Pakistan’s equity market. There is strong potential for Pakistan’s inclusion in the MSCI Emerging Markets (EM) Index as early as next year (CY26). If the upgrade does not materialize, its weight in the MSCI Frontier Markets (FM) Index is still expected to increase substantially from its current level of ~7.9% to ~11%.

The KSE-100 index has demonstrated strong performance, delivering a 49.4% return during the year, which outpaced both the MSCI EM (39.4%) and MSCI FM (29.9%) indices. Despite this, the market still trades at a significant 28% discount to regional peers.

Robust earnings growth forecasts for CY26 support this positive sentiment. Key sectors are projected to see significant expansion, driven by clear fundamental factors:

- Steel (82.9%): Growth is driven by an anticipated reduction in the policy rate and easing of electricity charges.

- Textiles (~64.7%): The sector is forecast to rebound on the back of reduced inventory costs and lower financing charges.

- Technology (~46%): Growth is fueled by higher global IT spending and rising investment in digital transformation across the MENA region.

Reflecting this outlook, the KSE-100 index targets for December 2026 indicate significant potential upside:

- Bottom-up Approach Target: 263,800 (implying a ~53.0% return)

- Earnings Growth Approach Target: 262,418 (implying a ~52.2% upside)

This forecast is justified by expectations of higher growth, a continued focus on reforms, and an anticipated re-rating of the market’s price-to-earnings (P/E) multiple from its current 8.4x to 11.0x.

Critical Juncture for Pakistan’s Economy

Pakistan’s renewed privatization drive is a central pillar of its IMF-backed economic reforms, designed to curb severe fiscal losses and enhance operational efficiency. The successful execution of these high-profile sales during CY26 will serve as a critical test of the government’s commitment. A positive outcome is not just a fiscal necessity; it is a crucial catalyst for unlocking the market re-rating detailed previously, with the potential to inject much-needed revenue, build foreign investor confidence, and reinforce the bullish outlook for the nation’s capital markets.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply