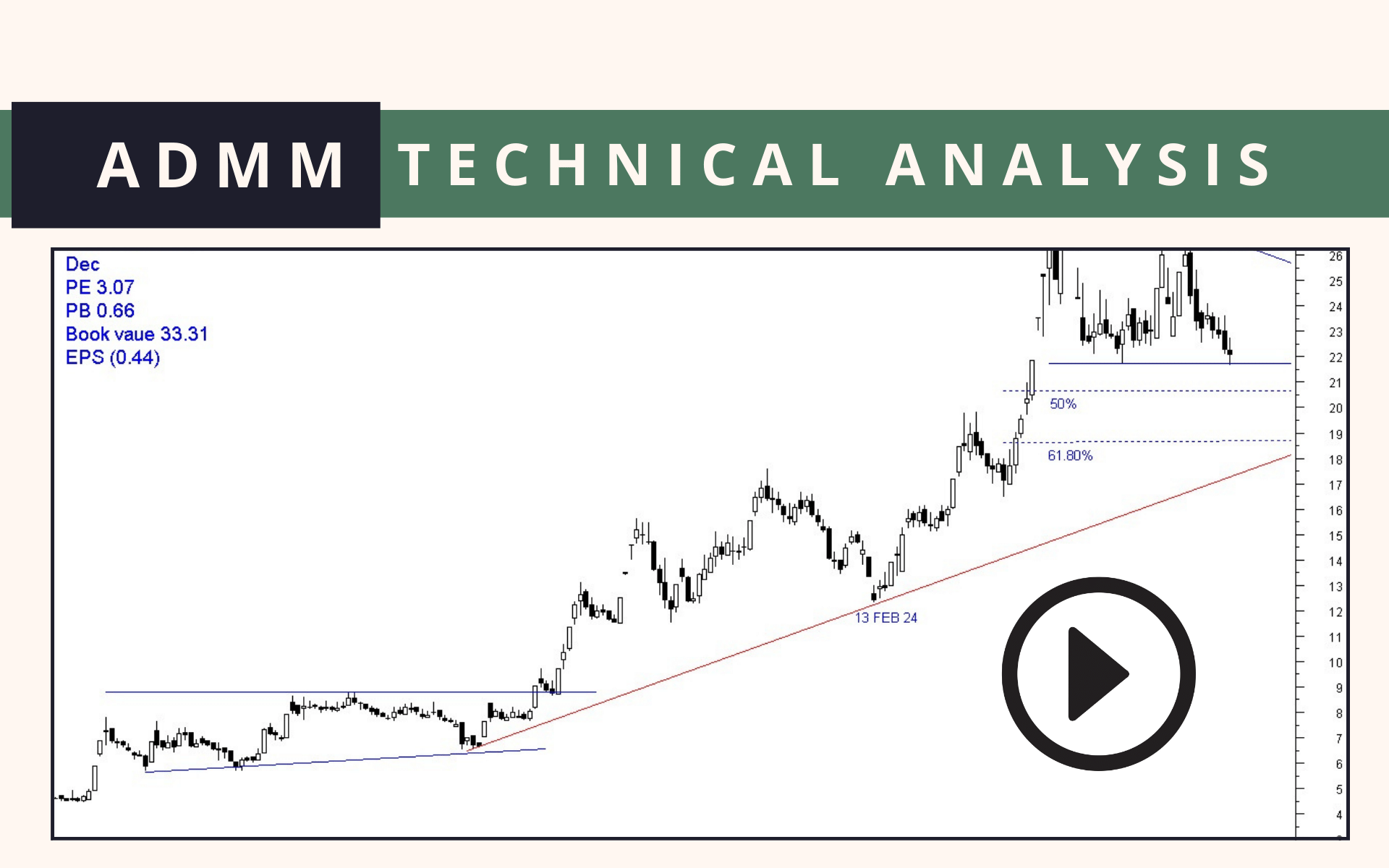

ADMM down 15% since December. Is it time for a breakout?

In this blog post, we will delve into the technical analysis of Artistic Denim Mills Limited (ADMM), a prominent company listed on the PSX.

The chart shows a falling wedge pattern closing in on the given support line.

Here is my detailed audio analysis.

📢 Announcement: We're on WhatsApp – Join Us There!

Here's what you get:

- Member-Only Discussion Community

- Research Reports with Explanations & Expert Views

- Access to Exclusive KSEStocks Market Reports

- Model Portfolio with Clear Investment Rationale

- Monthly Portfolio Review & Health Check

- On-Demand Stock Coverage Requests

- PSX Facilitation (CDC Account, Share Transfer, Physical Conversion)

When analyzing for long term, our analysis is valid for a longer period of time.

The current trend is sideways, making a falling wedge. The price is closing in on the support line.

If the falling wedge breakout happens, it may turn into a bull trend. (75% chances of upbreak, 25% of downbreak).

Don't miss:

- Which cars are driving the rally in auto stocks?

- Is DGKC going to Rs. 240?

- Why TPLP could go higher.

After breakout, the price may again stay sideways for a month or so.

Recent volumes are increasing.

The company may benefit from falling interest rates.

Free float is only 5% so volumes are always low. Therefore risk should be taken with a small amount.

Mr. Israr Ul Haq is a highly experienced and respected technical trader with over 25 years of expertise in the Pakistan Stock Exchange (PSX). He has developed a deep proficiency in reading and interpreting chart patterns, technical indicators, and market trends, which has been instrumental in his sustained success over the decades. He also operates in the Turkish Stock Exchange(Borsa Istanbul).

He can be reached through his WhatsApp Debate Group.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply