Why pharma exports could be Pakistan’s next billion-dollar opportunity?

Pakistan’s pharmaceutical industry has been on an upward trajectory thanks to deregulation, margin expansion, and a rising domestic market. But a far less discussed, and massively underutilized, opportunity lies beyond its borders: pharmaceutical exports.

While the local market still dominates the revenue pie, the sector’s long-term growth runway could be supercharged by exports, especially as capacity increases and global healthcare demand rises. Let’s break down why this might be the next big frontier for pharma investors in Pakistan.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Huge potential, tiny base

Despite having over 700 licensed pharmaceutical companies, Pakistan’s pharma exports stand at only around USD 300–400 million annually, a fraction of its real potential. In contrast, countries like India have built billion-dollar export engines by focusing on generics and low-cost production. Pakistan has similar strengths, affordable skilled labor, competitive cost structures, and a growing manufacturing base.

Yet, with most companies still focused on local sales, this export potential remains largely untapped.

The margin story: exports offer premiums

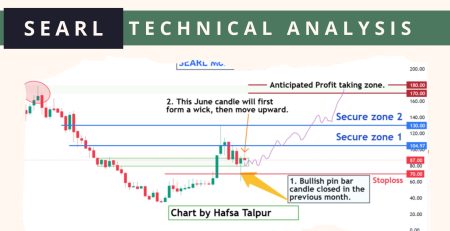

Exports tend to offer better margins than domestic sales, especially in regulated international markets. For companies like AGP, Searle, and Getz, entering even small regional markets can lead to incremental revenue with higher dollar-based returns. With the rupee’s depreciation, this foreign currency income also acts as a natural hedge.

📢 Announcement: We're on WhatsApp – Join Us There!

In fact, firms with US FDA, EMA, or GCC certifications can command premium pricing, making every dollar exported more profitable.

The global need for affordable generics

The world is facing an increasing demand for affordable medicines, driven by aging populations, rising chronic illnesses, and health coverage expansion in emerging economies. Pakistan’s pharma industry, with its competitive pricing, is perfectly positioned to fill this gap.

Countries in Africa, the Middle East, and Central Asia could be natural markets. Some companies like Searle and Haleon have already resumed exports to markets like Kenya and Afghanistan, early signs that momentum may be building.

Policy support could unlock the floodgates

Pakistan’s inclusion in the WHO prequalification programme, easing of branding restrictions, and support for export marketing through TDAP could open the gates for wider international recognition.

What’s missing is coordinated policy support to help companies attain global certifications and streamline the export licensing process. If addressed, Pakistan could realistically target USD 1 billion in pharma exports within 3–5 years.

Investors should watch for first movers

Export potential won’t be captured equally. Companies with strong compliance, excess capacity, and quality management systems are best positioned to lead the way. Look for:

- Export certifications (e.g., WHO, GCC, MHRA)

- Expansion into OTC and lifestyle products

- Dedicated export divisions or JV partnerships abroad

Final word

Pakistan’s pharmaceutical export engine is barely in gear, but the global market is waiting. With the right policy push and strategic focus, pharma exports could be the next major value driver for companies and investors alike.

For those looking beyond the domestic growth story, this is a goldmine worth watching.

Source: Optimus Capital Management Research Report

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply