Top 3 Stocks by ROE for 2026 According to Foundation Securities

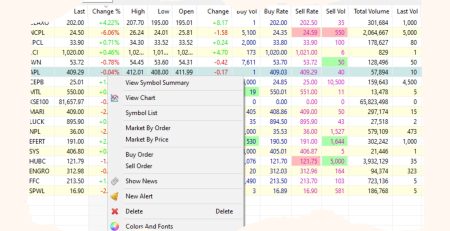

In its comprehensive “Pakistan Strategy 2026: Momentum in Motion” report, Foundation Securities presents a bullish macro-outlook, setting a December 2026 KSE-100 Index Target of 214,000, which implies a potential upside of 28.8%. This analysis spotlights the high-growth engines expected to help drive this market momentum by focusing on a key indicator of corporate performance: Return on Equity (ROE). ROE measures a company’s profitability and its efficiency in generating profits from shareholder equity. This article will explore the top three companies with the highest projected ROE for 2026, as identified in the Foundation Securities valuation snapshot, and the strategic triggers behind their strong forecasts.

3. AIRLINK (Air Link Communication Limited): Assembling a High-Growth Future with a 37.1% ROE

AIRLINK is the third high-ROE company highlighted, with a projected ROE of 37.1% for 2026. In the context of a stabilizing economy poised for growth, AIRLINK’s strategy is centered on capturing rising consumer discretionary spending and technological adoption. Foundation Securities’ rationale for this pick focuses on the company’s strengthened domestic footprint, margin augmentation from an operational shift, and a favorable future tax structure.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Key Bullish Triggers for AIRLINK

The bullish outlook for AIRLINK is underpinned by three core drivers:

Strengthened Domestic Footprint: AIRLINK is solidifying its position as a trusted local partner for top global brands. Recent initiatives include the successful launch of the iPhone 17 lineup, opening a Samsung Experience Store at Dolmen Mall, Lahore, and preparing to unveil Pakistan’s first official Apple Store at the same site.

Augmented Margins from Assembly: The company has strategically shifted its focus from distribution to assembly. This move has had a positive impact on profitability, with gross margins rising to 13.9% in the first quarter of FY26.

📢 Announcement: We're on WhatsApp – Join Us There!

Favorable Tax Structure: AIRLINK plans to shift its assembly unit to the Sundar Special Economic Zone (SEZ), which will grant the company a tax holiday until 2035. This relocation is projected to result in significant annualized tax savings of PKR 4-5 per share.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply