Is Descon Oxychem (DOL) past its best?

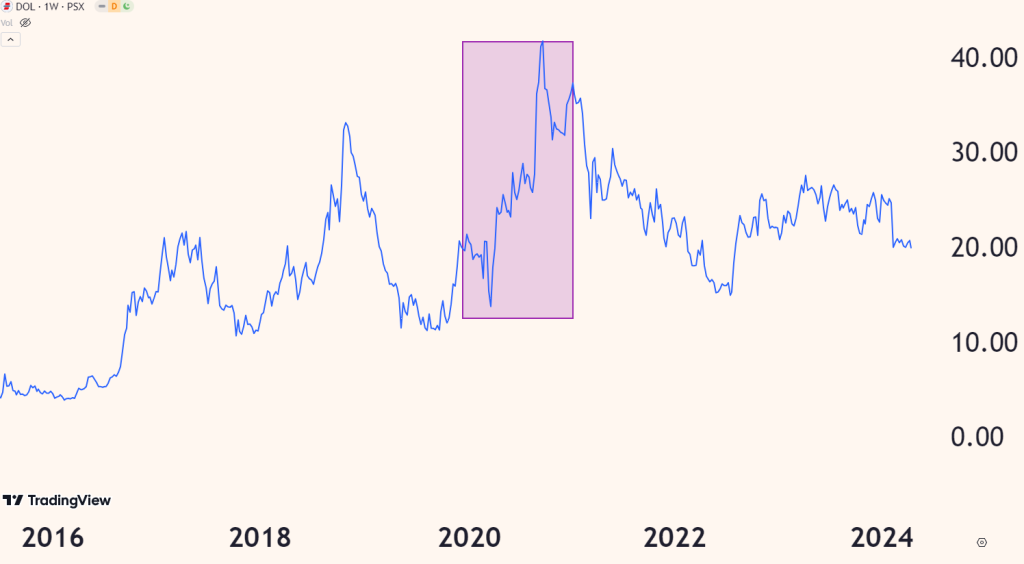

Descon Oxychem Limited (DOL) was a beneficiary of the Covid19 crisis, where its product ‘SANIDOL’ was a great success. The company was able to boost its revenues based on the sales of this product. It was during this time that the stock also reached its all-time high of Rs. 41.76.

Since the success of that product, the company has been paying out consistent dividends, which has attracted some long-term and dividend investors to it as well.

In the recent bull market, however, the stock has failed to perform. While the main reason for that is depressed international margins, there is also the factor that the company has found it hard to build on its post-covid success. Hydrogen peroxide (H2O2) had favourable conditions in those years and the company enjoyed great profits. Now that the high global production and reduced demand have resulted in reduced margins, the company is feeling the heat.

📢 Announcement: We're on WhatsApp – Join Us There!

Here's what you get:

- Member-Only Discussion Community

- Research Reports with Explanations & Expert Views

- Access to Exclusive KSEStocks Market Reports

- Model Portfolio with Clear Investment Rationale

- Monthly Portfolio Review & Health Check

- On-Demand Stock Coverage Requests

- PSX Facilitation (CDC Account, Share Transfer, Physical Conversion)

The company’s margins are under pressure. It is hard for DOL to increase its prices because a good portion of the market share belongs to importers of H2O2 and DOL has to keep its prices in sync with international prices. This means it has no pricing advantage against its competitors and cannot improve its margins by demanding higher prices.

On the bright side, the company sells 80% of its volumes on cash, which helps it keep its cashflows healthy.

Diverse product mix

Things are not all that bad for DOL though. The company continues to diversify into other products and recently upgraded its food-grade production capacity. It supplies products to multinational companies like Nestle. The company holds 95% of the total market share here and also has the ability to export once it gets the right certifications done.

Don't miss:

- Which cars are driving the rally in auto stocks?

- Is DGKC going to Rs. 240?

- Why TPLP could go higher.

This diversification helps the company’s revenues and helps reduce its dependence on the textile sector.

While the management continues to try to diversify further, it has explained in its last corporate briefing that it will pay out profits in the form of dividends if its upcoming projects do not materialize.

So the management is trying its best to improve the company’s business and seems focused on continuing to improve its business.

Less dependance on gas

The company does not rely that much on natural gas, which makes it immune to gas price hikes that have recently plagued other industries. Still, the company’s 2023 finances show its cost of goods sold increased, mainly due to higher RLNG prices and higher electricity prices.

The threat from EPCL

EPCL is about to enter the H2O2 market as well. They will likely control the southern market as DOL is north-based and may not be able to compete with EPCL due to freight costs to the south. Therefore, DOL’s south market is likely to suffer at the hands of EPCL.

However, EPCL itself is facing delays and with international margins under pressure, it is probably in no hurry to start production. This gives DOL more time to enjoy its significant position in the market.

Shrinking margins

This is what the half-year result looks like for DOL:

| Item | 2QFY24A | 2QFY23A | YoY | 1HFY24A | 1HFY23A | YoY |

|---|---|---|---|---|---|---|

| Net Sales | 1,401 | 1,782 | -21% | 2,899 | 3,483 | -17% |

| Cost of Sales | (1,204) | (956) | 26% | (2,315) | (1,814) | 28% |

| Gross Profit | 198 | 826 | -76% | 584 | 1,669 | -65% |

| Administration Expenses | (51) | (44) | 17% | (99) | (74) | 33% |

| Selling and Distribution Cost | (45) | (53) | -15% | (91) | (78) | 16% |

| Other Operating Expenses | (12) | (50) | -76% | (37) | (105) | -65% |

| Other Income | 74 | 28 | 167% | 128 | 41 | 215% |

| Finance Cost | (6) | (7) | -9% | (13) | (14) | -4% |

| PBT | 157 | 700 | -78% | 472 | 1,439 | -67% |

| Taxation | (91) | (211) | -57% | (207) | (431) | -52% |

| PAT | 66 | 489 | -86% | 265 | 1,008 | -74% |

| EPS | 0.38 | 2.79 | 1.51 | 5.76 | ||

| DPS | – | 2.00 | – | 2.00 | ||

| Gross Margin | 14% | 46% | 20% | 48% |

As you can clearly see, the cost of sales is rising, the revenues decreasing, and the gross margins shrinking as a result. This is why the stock price has been under pressure lately.

Perhaps the only thing that will improve the company’s performance is an uptick in international margins. Until that happens, investors are likely to stay away from this company.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply