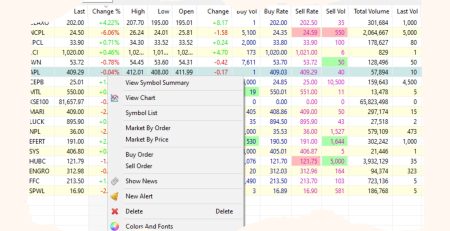

How to read the payouts section of a stock

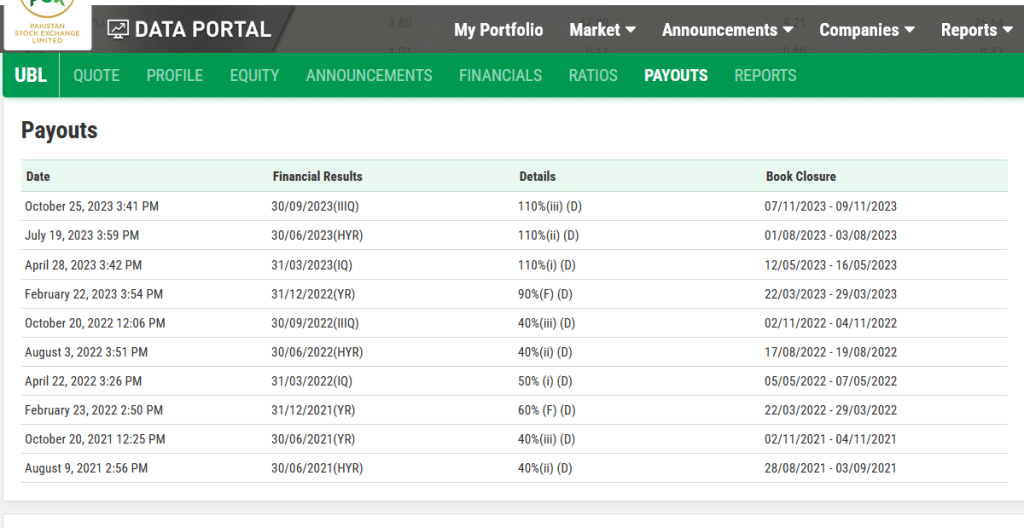

Pakistan Stock Exchange provides the payouts history of a stock on its stock page in the data portal. If you open a stock’s page and go to the payouts section, you can see the following:

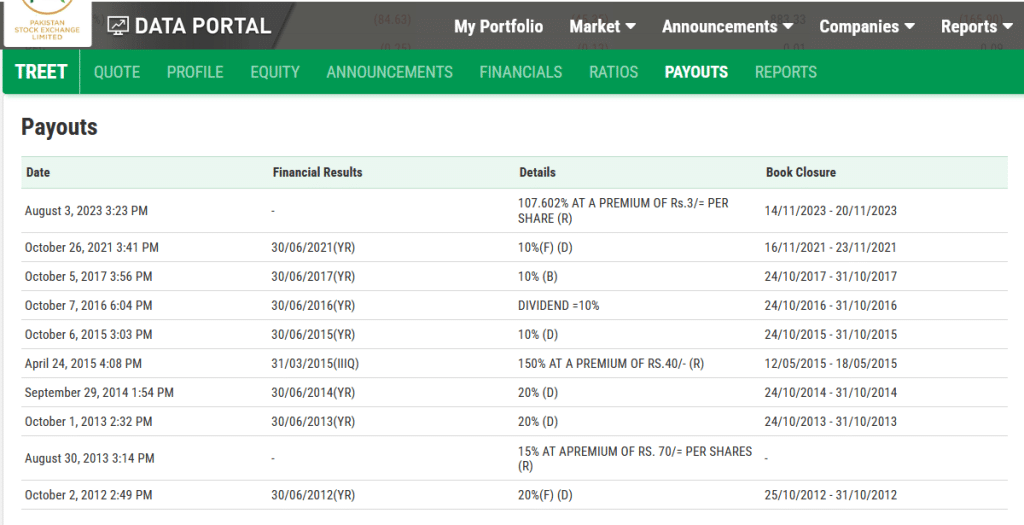

Here is the payouts section of another company TREET:

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Let’s understand how to read the payouts section.

What does % mean?

All dividends(D) are mentioned as a percentage of ‘face value’. You can visit the listed companies page to see the face value of the stock.

📢 Announcement: We're on WhatsApp – Join Us There!

For example, if a stock’s face value is Rs. 10, and it announces 25% dividend, then the dividend amount is Rs. 2.5(25% of 10).

If a stock’s face value is Rs. 5, and it announces 40% dividend, then the dividend amount is Rs. 2(40% of 5)

All bonuses(B) are announced as a percentage of your total holding. For example, if a stock announces 20% bonus, and you hold 1000 shares, you will get 200 shares(20% of 1000) as bonus.

All rights(R) are announced as a percentage of your total holding. For example, if a stock announces 10% rights, and you hold 1000 shares, you can subscribe to 100 shares(10% of 1000) as right shares.

What do D, B, and R mean?

D stands for dividend.

B stands for bonus shares.

R stands for right shares.

What do (i), (ii), (iii), and (F) mean?

This refers to the number of payout in the fiscal year.

i stands for interim while F stands for Final.

For example, if a share announces its first dividend of the year in the third quarter, then that dividend will have (i) written in front of it because it is the first payout for that year.

What does Book Closure mean?

Book Closure dates are used to determine who is eligible to get the payout. It is used to determine the ex-date of the stock. You can check the book closure dates of all stocks from the Book Closure Page.

The ex date is calculated as “BC – 2”, which means Book Closure Start Date minus 2 working days. Since you need to be holding the stock when it goes ex, you need to buy it at least one day before the ex date. This means “BC – 3” is the last date to buy that stock to claim the payout.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (5)

Easy point by point explanation of the required material

Thanks for the info.

Well done sir,You explained everything very well in an easy way.

Thanks!

Thank you for making the learning process of stock market easier. I wonder if the examples of BC -2 could be given for simplification of the concept.