Highnoon (HINOON): Non-Essential Drugs Portfolio Offers Fundamental Strength

Highnoon Laboratories Limited is engaged in production, marketing, and distribution of pharma and consumer healthcare products. Company has a market capitalization of PKR 61.6 billion with 40% free float, and has been consistently ranked amongst the top 15 pharma companies in Pakistan. Company registered consolidated revenues of around PKR 25 billion in 2024 and has posted above-average topline growth in the last 5 years, with a CAGR of 21%.

Volumetric Growth in Non-Essential Drugs

Non-essential drugs generally offer higher margins to pharma players, allowing for more profits. Hence, companies benefit from sales of such medicines, either on a volumetric or pricing terms. However, it is important to understand this in the context of product portfolios of pharma companies. Not many companies have a large number of non-essential offerings, which increases their reliance on fewer products. This often pushes companies to raise prices of these non-essential drugs to secure high margins.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

But as stated, such dependency on price hikes is typical of companies that do not have a well-diversified portfolio of non-essential drugs. In that regard, Highnoon is amongst the very few companies in Pakistan that have more than 50% portfolio concentrated within non-essential drugs category. This allows the company to enjoy such high margins without any major price adjustments. They are able to expand their revenues through volumetric growth, which is more sustainable.

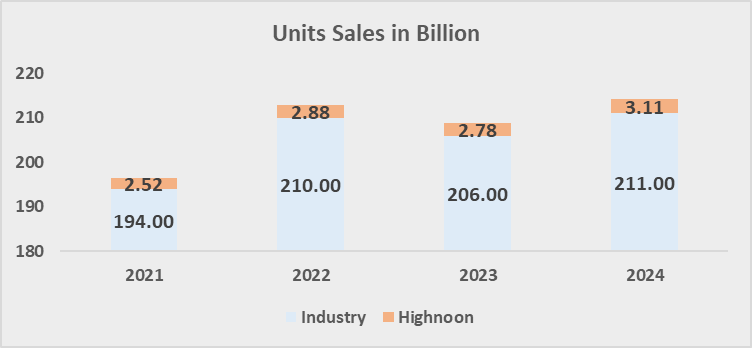

I presented a detailed analysis of how industry volumes had been affected after DRAP implemented price deregulation policy in 2024. The policy was aimed at non-essential drugs and eventually was applied to 146 essential drugs as well, that fell within the hardship category. The resulting price hikes backfired for the industry as volumes could not replicate the sales growth through price appreciation.

In a way, price deregulation policy could work in Highnoon’s favor, as they could see their volumes expanding at the expense of other players who have been hiking prices. As shown in the graph below, Highnoon outperformed the industry by 2.5x in volumetric terms during the last 4 years.

Highnoon Product Portfolio

📢 Announcement: We're on WhatsApp – Join Us There!

Highnoon Laboratories’ product portfolio is spread across a diverse array of therapeutic areas that cater to both acute and long-term medical conditions. Unlike many other companies, Highnoon Laboratories has a significantly large chunk of non-essential offerings. With a target of 7-8 new products every year, company continues to innovate and rolled out 15 new products in 2024. Currently there are more than 150 products being offered and there are 8 brands that fall within the “1 billion club”.

Product portfolio is spread across the following major therapeutic classes.

The above mentioned therapeutic classes contain several high quality brands, that are packaged and sold as unique Stock Keeping Units (SKUs). Apart from legacy brands like Ulsanic, Tagipmet, Combivair, and Triforge, Highnoon is also a key player within the anti-infective market through a wholly owned subsidiary, Curexa Health Private Limited.

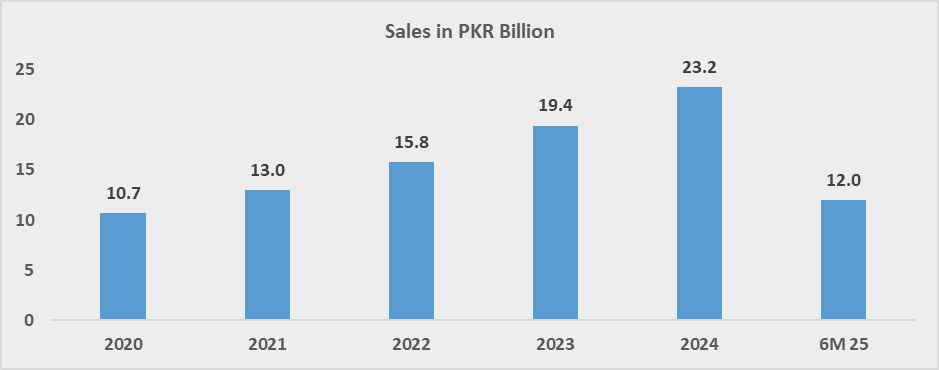

Financials

Strong volumetric growth for Highnoon, resulted in topline CAGR of 21% from 2020 till 2024. Superior product quality, extensive distribution network and strong brand recognition were the driving factors behind these revenues. As discussed earlier, a strong mix of essential and non-essential drugs allows for higher unit sales without major price hikes. 2024 marked 4 new brands joining the company’s “1 billion club”, i.e. Tagipmet XR, Biforge, Truforge, and Misar. Company’s commitment towards continued innovation and new product launches every year is another critical factor behind industry leading sales growth.

Highnoon recorded PKR 12 billion in net revenues during the first half of 2025. This positions them to carry on the growth momentum witnessed in the last 5 years.

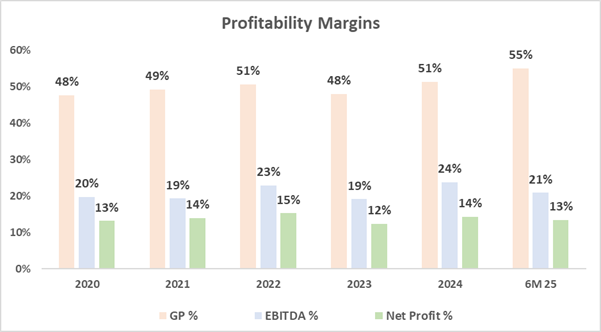

In terms of profitability margins, Highnoon Laboratories stands out amongst its listed peers. Gross margins have averaged around 50% since 2020, raising up 55% during the first half of 2025. There is a potential to further enhance gross margins as pharma industry continues to explore local options for procurement of active pharma ingredients (APIs), which is the major component of production cost.

Further, EBITDA margins for the company have consistently ranged between 19%-24% during the last 5 years through efficient operational controls. This combined with strong other income and low financing costs have resulted in net margins in the range of early to mid-teens.

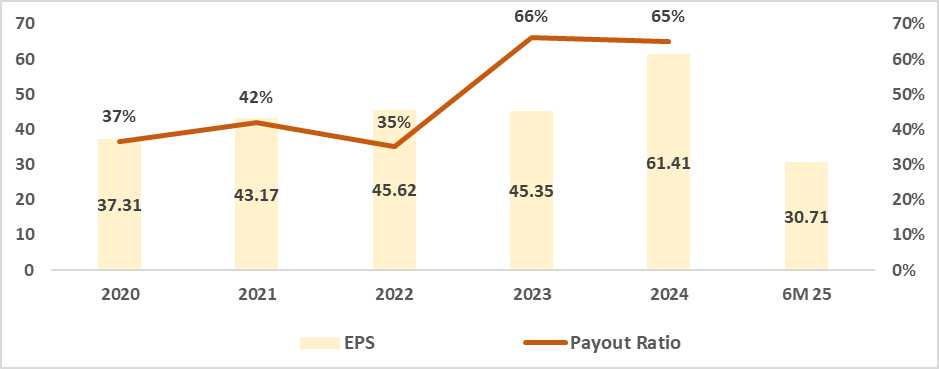

Noticeable growth in profitability has allowed the company to reward shareholders with strong payouts. Dividend payout ratio jumped from 35%-40% range to 65% in 2024. Such payout ratio has proved to be a catalyst for a bullish trend experienced in Highnoon shares since last quarter of 2023.

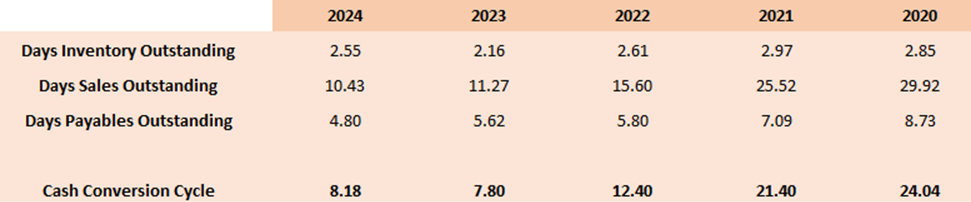

It is also important to highlight Highnoon efficient working capital management, which has resulted in a substantial decline in the overall cash conversion cycle. As shown in the table below, between 2020 and 2024 cash conversion cycle dropped from 24 days to just 8.18 days. Hence, over the course of 4 years, company has become 3x more efficient in converting its initial investment in inventory into cash proceeds.

Given the above trends, company’s cash flows from operating activities increased from PKR1.3 billion in 2020 to a whopping PKR4.2 billion in 2024. Such organic cash flow generation keeps Highnoon from borrowing large sums of money for its operations, which was reflected during 2024 when the company reduced its non-current liabilities by PKR 500 million.

Moreover, since 2019 net cash flows from financing activities have been negative, showing how the company has been focused on paying off its obligations. There was a massive outflow of circa PKR2.3 billion during 2024.

| Cash Flows from financing activities (PKR Million) | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| (459) | (79) | (712) | (851) | (209) | (2,288) |

Cross Border Collaboration

Company recently signed a Memorandum of Understanding (MoU) with Beximco Pharmaceuticals based in Bangladesh. Through this partnership, Highnoon will promote Beximco’s specialized pharma products in Pakistan, covering a range of therapeutic classes. There will be a particular emphasis on advanced therapies for respiratory, diabetes and cardiovascular diseases.

This collaboration reflects favorably on Highnoon’s future plans for expanding internationally, to increase their existing export share. Currently, Highnoon generates circa 7% of its revenues through exports, which is higher than industry average of 5%. Company has so far penetrated into several destinations including Afghanistan, China, France, Indonesia, Iraq, Kenya, Netherlands, Spain, Turkey, Tanzania and UAE.

In my previous article on Pakistan pharma export potential, I highlighted the need for local players to explore untapped international markets. FY25 saw a rise of 34% in pharma exports, which stood in excess of $450 million. But this represents only a 5-7% share of topline for local, which shows there is further room to expand. Being one of the top 15 players in the industry, backed by an attractive product portfolio, Highnoon could lead the way for the local industry into new regions.

Final Word

I am bullish on Highnoon Laboratories, based on business fundamentals. Although many investors would be skeptical of that due to massive jump in share price since late 2023, the stock is still trading at a TTM P/E ratio 17x compared with industry average of 24x. This indicates possibility for further capital gains along with attractive payout ratio.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (2)

Does it matter that Abbot, GlaxoSmithKline etc. have their own research based products while local companies do not have their own products?

Local pharma companies offer a wide range of their own products, although many companies have in-licensing agreements with global companies too. I agree the likes of GSK and Abbott have more extensive R&D and innovation capabilities in biotechnology, which gives them an edge over local manufacturers.