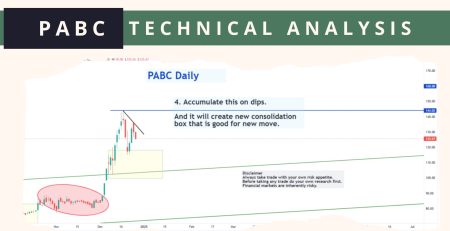

Following solid earnings, can PABC continue rising in 2025?

Pakistan Aluminium Beverage Cans Limited (PABC), the country’s first and only manufacturer and exporter of aluminium beverage cans, reported a resilient performance for CY24 and 1QCY25. Despite export headwinds and margin pressures, the company posted double-digit earnings growth, thanks to strong operational execution and growing local demand.

Let’s dive into the key highlights from the recent corporate briefing session.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

CY24: strong earnings growth on the back of robust exports

In CY24, PABC recorded a 17% year-over-year growth in revenue, reaching PKR 23 billion. Exports were the star of the year, contributing 63% of total sales, rising by 53% YoY to PKR 14.4 billion. This export-led growth reflects PABC’s strong position in regional markets, although management highlighted challenges ahead.

On the bottom line, net profit rose to PKR 6 billion, up from PKR 5 billion last year. As a result, EPS climbed to PKR 16.9/share from PKR 13.9/share. Despite some margin compression due to cost pressures, net profit margins slightly improved, showcasing efficient cost management.

1QCY25: earnings jump despite export challenges

In 1QCY25, PABC maintained its momentum. Revenue stood at PKR 4.65 billion, almost flat compared to the same period last year. But the real story was in profitability:

- Net profit rose 44% YoY to PKR 1.3 billion

- EPS jumped to PKR 3.54/share from PKR 2.50/share

- Net margin surged to 27% from 19% in 1QCY24

📢 Announcement: We're on WhatsApp – Join Us There!

This jump was primarily driven by a 21% increase in local sales, thanks to stronger domestic demand. However, export sales fell 18% YoY, largely due to the temporary closure of the Torkham border, which disrupted trade with Afghanistan, one of PABC’s key markets.

Operational efficiency and capacity expansion

The company produced 936 million cans in CY24 at 89% capacity utilization, indicating healthy demand. With a production capacity of 1.2 billion cans per annum, PABC is operating near full efficiency. To prepare for future demand, the company is expanding capacity to 1.3 billion cans per year, a project expected to be completed in the next six months.

Looking ahead: targets and risks

For CY25, PABC is projecting:

- Revenue of PKR 22 billion

- Sales volume of 890 million cans

However, the management cautioned that gross margins could remain under pressure in the current year. They also flagged several risks that could weigh on performance:

- Volatility in aluminium and commodity prices

- Geopolitical tensions, especially border issues with Afghanistan

- Removal of SEZ tax benefits (the company currently enjoys zero taxation until 2026)

- Expansion by regional competitors

Long-term outlook remains positive

Despite short-term challenges, PABC remains a well-managed company with strong fundamentals. Its position as the only aluminium can exporter in Pakistan, coupled with a growing domestic market and capacity expansion plans, bodes well for long-term investors.

But risks remain, especially around border dynamics and fiscal policy. Investors should keep a close eye on how these factors play out in the coming months.

Source: Taurus Securities Limited

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply