Everything You Need to Know about a Minor Investor Accounts

Imagine giving your child an 18-year head start in the world of wealth creation. By the time they reach adulthood, the magic of compounding could have already turned small, consistent contributions into a significant financial foundation.

To foster this early investment culture, the Pakistan Stock Exchange (PSX), NCCPL, and CDC have established a specialized framework for Minor Investor Accounts.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Legally, the minor is the sole beneficiary and owner of the assets, while you, the guardian, manage the operations and decisions.

Core Advantages of a Minor Investor Account

- True Financial Ownership: These accounts allow minors to legally own securities. Every dividend, profit, and capital gain accrued belongs to the child, allowing their portfolio to grow alongside them.

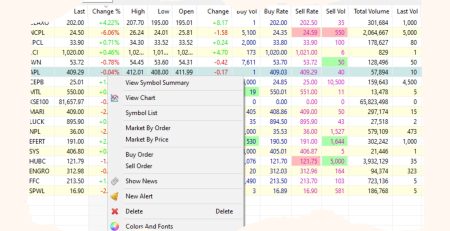

- Built-in Safety Measures: For your peace of mind, these accounts are restricted to “Ready/Regular” markets. This regulatory “safety net” prevents exposure to high-risk, speculative products like futures or leveraged trading, keeping the focus on stable, long-term growth.

- Tax-Efficient Transition: One of the most rewarding features is the maturity process. When your child turns 18, the transfer of securities to their new adult account is treated similar to a gift, meaning it is not considered a taxable “disposal.”

- Expert Guardian Control: While the minor owns the assets, the guardian retains exclusive control over all instructions. This ensures that the portfolio is guided by adult responsibility and seasoned judgment until the child is ready to take the reins.

How the Account Operates: Key Facts for Parents

We want to ensure you understand the “backend” of how these accounts function to keep your investments compliant and secure:

- The Guardian’s Role: The Father is the default guardian, but the Mother or a Court-appointed individual may also serve. If the guardian is anyone other than the father, a Court Attested Guardianship Certificate is required.

- Tax & Settlement Handling: For your technical awareness, the Guardian’s Unique Identification Number (UIN) serves as the primary reference for all trade settlements and Capital Gains Tax (CGT) computations until the minor reaches 18.

- Verified Fund Routing: To protect the minor’s interests, you must select one of three verified routes for money transfers in your signed undertaking:

- The Minor’s own bank account (opened through the guardian).

- A Joint account (Minor + Guardian).

- The Guardian’s individual bank account.

- Strict Prohibitions: There are no exceptions for third-party transfers. All receipts and payments must flow through the single route selected in your legal undertaking.

Security and Restrictions: Keeping Investments Safe

To protect your child’s capital from volatile or speculative strategies, the following restrictions are enforced by the exchange:

- [x] No Futures Markets (DFC, CSF, or Options).

- [x] No Leverage or Margin Products (MFS, MTS).

- [x] No Negotiated Deals Market (NDM).

- [x] No Same-day Square-ups (Intraday offsetting).

- [x] No KATS Access (No direct market access for the minor).

Setting Up the Foundation: Your Documentation Checklist

📢 Announcement: We're on WhatsApp – Join Us There!

Opening an account is a streamlined process. Remember, only the guardian signs the official forms (CRF, KYC, and AOF); the minor does not need to sign any documents.

Minor’s Identification Documents

- Juvenile CNIC, Form-B, or Child Registration Certificate (CRC) from NADRA.

Guardian’s Requirements

- Valid CNIC Front and back copies for identity verification.

- Verification Successful Biometric and Email verification.

- Income Proof Salary slip, employment proof, or latest bank statement.

- IBAN Proof Copy of a cheque, bank letter, or digital screenshot of the verified account.

- Commission Sheet A mandatory signed document detailing the agreed brokerage rates.

- Guardianship Proof | Required only if the guardian is not the Father (Court Attested Certificate).

- Guardian’s Undertaking | The primary legal contract acknowledging responsibility for compliance.

KSEStocks will provide the account opening forms at the time of account opening.

What Happens When Child Turns 18?

As your child approaches adulthood, the system ensures a transparent transition of their wealth. Rest assured, the regulators maintain a clear “audit trail” to link the guardian’s UIN to the child’s new UIN, preserving all cost and acquisition data.

- 30-Day Notice: The NCCPL will send a notification 30 days before the minor’s 18th birthday to help you prepare.

- Maturity Suspension: On the 18th birthday, the account enters a “Suspended” status. Trading and transfers are blocked, though you may still sell existing holdings to liquidate the account if desired.

- The FIFO Transition: Once the now-adult opens their new independent account, the holdings are transferred using the First-In-First-Out (FIFO) principle. This ensures continuity in cost records for future tax purposes.

- Final Handover: After the transfer, the minor account is closed, and all future gains and tax liabilities shift to the individual’s own UIN.

How to Get Started

Securing your child’s financial future is a step you can take today. We have made the onboarding process fast and hassle-free through our affiliation with JS Global.

Step 1: Gather Your Documents Prepare soft copies of the CNIC (Guardian & Nominee), Minor’s ID (Form-B/CRC), IBAN proof, and Proof of Income.

Step 2: Submit via WhatsApp Send your documents to +92 3378205259.

Step 3: Provide Essential Details In your message, please include the following information:

- Phone Number & Email Address

- Full IBAN

- Mother’s Name

- Occupation & Job Title

- Employer Name & Employer Address

Let’s build your child’s legacy together.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply