Citi Pharma(CPHL): Shift Towards Localized APIs Could Mitigate Underlying Risks

Citi Pharma Limited (PSX:CPHL), is amongst the largest producers of Active Pharmaceutical Ingredients (APIs) in Pakistan, playing a critical role in the local pharma industry. Apart from catering to the needs of hospitals and healthcare institutions, it supplies APIs to major pharma players in the country.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

For context, Pakistan relies heavily on imports of APIs as 85% of the industry needs are being met through sourcing from China and India. Local API manufacturers have been limited to basic or intermediate therapeutic categories due to a lack of adequate testing and R&D facilities. Moreover, only 7 out of the 23 licensed API manufacturers are currently functioning to meet the local industry requirements.

In one of my previous articles on industry volumes, I highlighted the structural challenges faced by local pharma players due to high operational costs. Expensive API imports make up the largest chunk of such costs and dampen the profitability margins. In response to that, manufacturers have been increasing drug prices in line with the deregulation policy implemented in 2024.

After prices surged for many non-essential drugs, there was a backlash from end consumers who are finding it extremely difficult to afford medicines. In such a scenario, industry stakeholders are aiming to switch towards localized sourcing of APIs, in order to keep prices in an affordable range without taking a hit on their own margins.

📢 Announcement: We're on WhatsApp – Join Us There!

In this article, I will assess Citi Pharma’s future prospects only in the context of its API offerings, which is the dominant one in terms of revenue streams. My analysis does not incorporate any recent developments around the diversification of Citi Pharma’s product mix, including their expansion into the veterinary healthcare segment.

Citi Pharma API Mix

Citi Pharma covers several therapeutic classes within its API product portfolio, which is the primary source of company revenues. API mix of the company is relevant for many of the local and multinational drug manufacturers in the country. These include antibiotics, anti-malarial, anti-inflammatories, anti-oxidants and analgesic. Some of the household products it covers include paracetamol, aspirin and ibuprofen. Following table shows few of the company’s major API offerings.

| API Segment | Therapeutic Class |

|---|---|

| Paracetamol | Anti-Inflammatory |

| Norfloxacin | Antibiotic |

| Amoxicillin | Antibiotic |

| Levofloxacin | Antibiotic |

| Cefixime | Antibiotic |

| Ciprofloxacin | Antibiotic |

| Cephradine | Antibiotic |

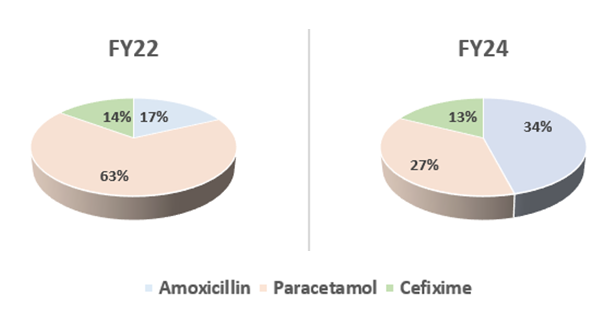

Antibiotics generate bulk of the revenue, after the company’s efforts to diversify the portfolio mix. The situation was starkly different up until a few years back, as paracetamol used to be the primary revenue generator. For reference, paracetamol contributed 63% to the overall revenue mix in FY2022, which exposed the company to a lot of product concentration risk.

Since 2023, focus had been drawn towards antibiotics segment. Amoxicillin Trihydrate now leads the mix with 34% revenue contribution in FY2024, followed by paracetamol at 27%. But there are still concerns about the product concentration risk, as 74% of overall sales in FY2024 came from only 3 products.

Citi Pharma’s customer base includes both local and foreign companies such as GSK Pakistan, Abbott Laboratories, Bayer, Searle, Ferozsons Laboratories, Barrett Hodgson and Haleon. But the company still faces a noticeable customer concentration risk, as top 3 clients account for around 46% of total. This included GSK Pakistan, who remain the biggest customer with almost 23% of revenue chunk. They are followed by Haleon Pakistan (17%) and Bosch Pharmaceuticals (6.5%).

Shift of industry focus towards sourcing of localized APIs offers significant opportunity to Citi Pharma to expand its coverage. They can tap into more therapeutic areas, that would enable them to meet demands of a more diverse customer base. Hence they could not only further diversify the API portfolio mix, but also address risks relating to the customer concentration. In that regard, the company will need to allocate more resources towards its R&D and testing capabilities to meet strict compliance and regulatory requirements.

Export Potential

In my article on Pakistan’s Pharma Export Potential, I shed light on country’s pharma exports that recorded the highest growth in 2 decades at 34%. I also highlighted a broader global coverage for the local industry, as companies are penetrating into new markets too. Pakistan Pharmaceutical Manufacturers’ Association (PPMA) is committed to explore more avenues, and would require friendly policies and support from the government.

Looking at the potential, Federal Minister for Commerce Syed Naveed Qamar emphasized on raising pharma exports, during the 6th Pakistan Pharma Summit in July. He reiterated on collaborative work to reach an export target of $5 billion for the pharma industry by 2030. By June 2024, total pharma exports were in access of $450 million, compared to $341 million in 2023.

In light of the global API market, there are opportunities for local API manufacturers such as Citi Pharma to expand their reach. These opportunities are expected to emerge as the value of expiring patents in 2025 are estimated at $380 billion. It is important to note that the overall global API market is expected to touch $309 billion by 2028.

Given the scenario, Citi Pharma can explore many export destinations with a more diverse portfolio mix as highlighted above. Although, tapping into such opportunities would require extensive efforts on R&D, compliance, quality controls and distribution. But as an alternative, the company can rely on long-term business collaborations. This would be a less costly option in trying to navigate their way into new markets.

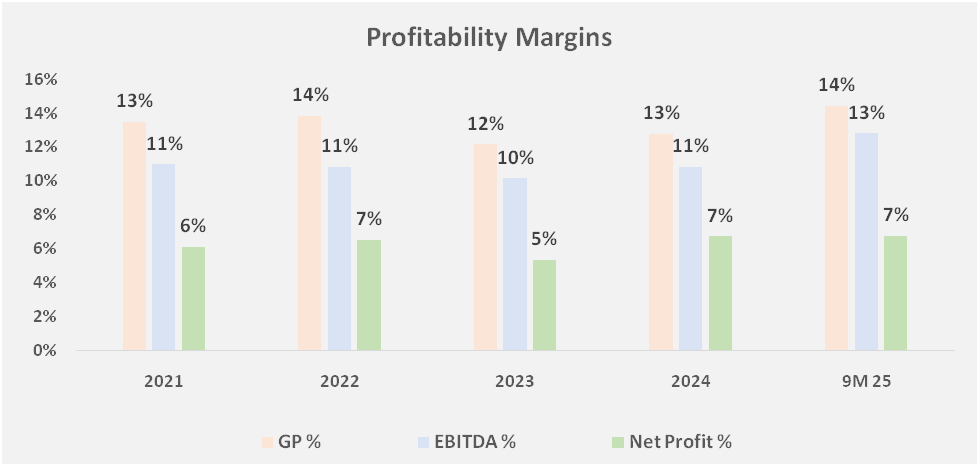

Short-Term Borrowings & Working Capital Risks

APIs are inherently low margin products, especially if you are operating within generics category, that is typically characterized with intense level of competition. Given Citi Pharma’s product portfolio, one can clearly guess the underlying reasons for net margins in 5-7% range on average. But there is room to expand on that by stepping into the specialized product categories, where the company could charge premiums. Following up on the company’s diversification strategy seen in the last 3 years, Citi Pharma can capitalize on their international links to offer such specialized APIs for higher profitability margins.

Apart from low margins, company is also dealing with inventory buildup and slower collections. This has taken a toll on working capital management, which does not look efficient. Besides an impact on the overall cash conversion cycle, these working capital challenges have also led to negative cash flows from operations, standing at PKR -602.5 million for 9 months ending March 2025. Going forward, addressing the company’s working capital needs more efficiently must be the management’s priority.

Valuation and Final Word

Citi Pharma is currently trading near its 3-year high range. In contrast to widespread opinion about being an overvalued scrip, Citi Pharma actually trades at a forward P/E ratio of 20.6x, compared with a 3-year industry average of 19.6x. Given a strong dip in share price in the last month, market is yet to price in company’s recent expeditions into the high-margin veterinary space and selling formulations directly to end consumers. With decent business prospects API segment, linked with international collaborations to expand coverage, Citi Pharma appears to be an attractive long-term play. However, investors should keep a critical eye on how such international ventures play out in the coming periods, along with their impact on financials.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply