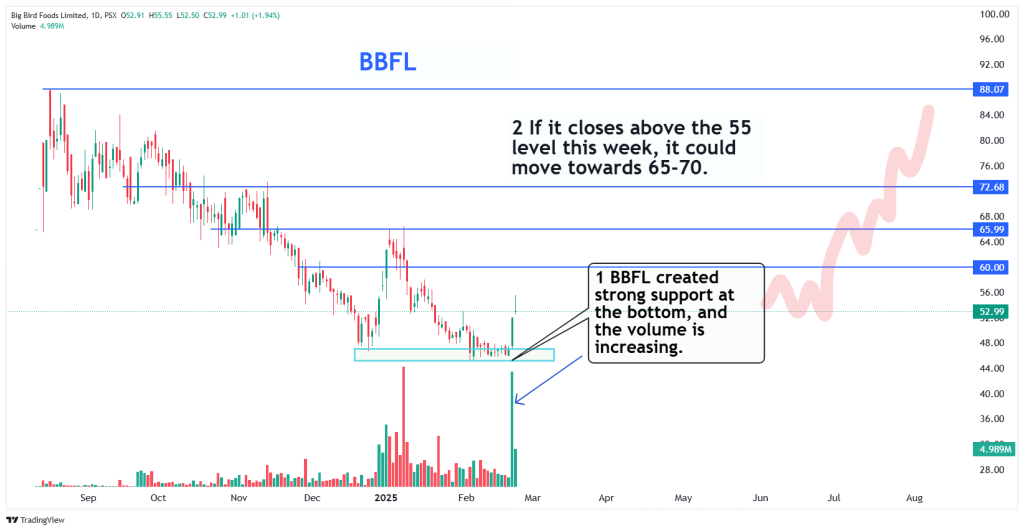

Big Bird Foods limited Ready to Deliver Strong Returns in the Short Term

Big Bird Foods limited (BBFL) is bouncing up from strong support.

The buying zones are between 53 and 49.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

A trend change would occur if the price closes below 46 on the daily time frame.

The overall market is choppy, so it’s better to secure 40% of the profit and let the runner continue

Profit securing points are at 60, 64, and 70. If it closes above 72, we could see a move towards 80

📢 Announcement: We're on WhatsApp – Join Us There!

Disclaimer

Always take trade with your own risk appetite.

Before taking any trade do your own research first.

Financial markets are inherently risky.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (4)

for a novice like me, price seem to move with the index (or index moves with prices) why isnt here any ref to the main index even time is important as ive noticed that prices change in morning or at break time

Not all indices have the same companies; it depends on the index you’re watching, such as the KSE-100, KSE-30, or KMI-30. Different indices have different stocks.

For example, the KSE-100 has 100 companies, but not all of them are necessarily traded on any given day. The index moves up and down in a zigzag manner. Some companies carry more weight (more weight means points) in the KSe100, such as FFC, OGDC, PSO, MCB, etc. So, the index may move up by 1000 points, with smaller stocks showing significant movements while the big companies remain relatively unchanged.

those are candles show rate fluctuation above, whats shown by the bottom bar graph, is it the volume?

Yes, it is volume.