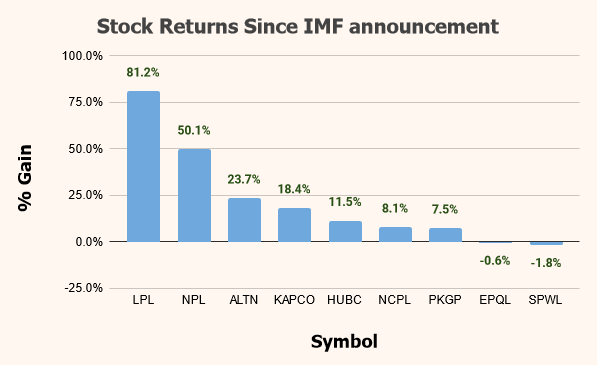

Stock returns since IMF announcement – Power Sector

Power Sector has been in the news lately after the government released a part of the payments it owed to companies in the sector. The speculation around the eventual dividend caused a lot of shares’ prices to skyrocket, giving traders and speculators handsome returns.

As is always the case in the stock market, it is not easy to predict share price movements or payouts. The same was the case here.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Two companies, Lalpir Power Limited(LPL) and PAKGEN Power Limited(PKGP) each announced a Rs. 15 dividend, further fueling the speculation. However, only LPL was able to give sustainable returns of 81% to the shareholders. PKGP shareholders were only able to get a paltry 7.5% return.

| Symbol | Name | Starting Price (3rd July) | Last Close | Div(Rs.) | Total Gain (Rs.) | % Gain (%) |

|---|---|---|---|---|---|---|

| LPL | Lalpir Power Limited | 16.07 | 14.12 | 15 | 13.05 | 81.21% |

| NPL | Nishat Power Limited | 17.98 | 23.98 | 3 | 9 | 50.06% |

| ALTN | Altern Energy Limited | 14.5 | 13.23 | 4.7 | 3.43 | 23.66% |

| KAPCO | Kot Addu Power Company Limited | 22.15 | 26.22 | 0 | 4.07 | 18.37% |

| HUBC | Hub Power Company Limited | 74.8 | 83.42 | 0 | 8.62 | 11.52% |

| NCPL | Nishat Chunian Power Limited | 17.86 | 19.3 | 0 | 1.44 | 8.06% |

| PKGP | PAKGEN Power Limited | 43.9 | 32.2 | 15 | 3.3 | 7.52% |

| EPQL | Engro Powergen Qadirpur Limited | 23.99 | 22.35 | 1.5 | -0.14 | -0.58% |

| SPWL | Saif Power Limited | 18.4 | 16.77 | 1.29 | -0.34 | -1.85% |

NPL has surprised many as even after announcing a lower than expected dividend, it has been able to sustain its price, giving investors 50% returns since July.

EPQL and SPWL have been disappointing and despite both giving a small dividend, their shareholders are down since the start of July.

📢 Announcement: We're on WhatsApp – Join Us There!

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply