Should You Invest in the IMAGE REIT IPO?

Investors in the PSX have experienced the success of Dolmen City REIT (DCR). For years, DCR was not only a consistent dividend payer but also a valuable tool for reducing portfolio volatility. Still, nobody got excited until it doubled in value in less than a year!

Now everybody wishes they had it in their portfolio. It is in this context and environment that the Image REIT IPO is being launched. Investors don’t want to miss out on another REIT, so naturally, the excitement is high. But how similar is Image REIT to DCR? Will it respond the same way as DCR did? We’ll find that out today in this deep dive.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

The basic stuff

To begin with, let’s get some basic stuff out of the way:

Sharia Compliant: Yes

IPO Size: Rs 920 million (92m units)

📢 Announcement: We're on WhatsApp – Join Us There!

Offer Price Range: Rs 10 – Rs 14 per unit

Retail Allocation: 25% of the issue

A hybrid REIT:

Image REIT is a hybrid REIT, meaning it has a rental component and a developmental component. Let’s look at both of them in detail.

1. The rental component:

Image REIT owns an office building on Main Shahrah-e-Faisal. This building is 100% occupied and generates healthy cash flows for the REIT.

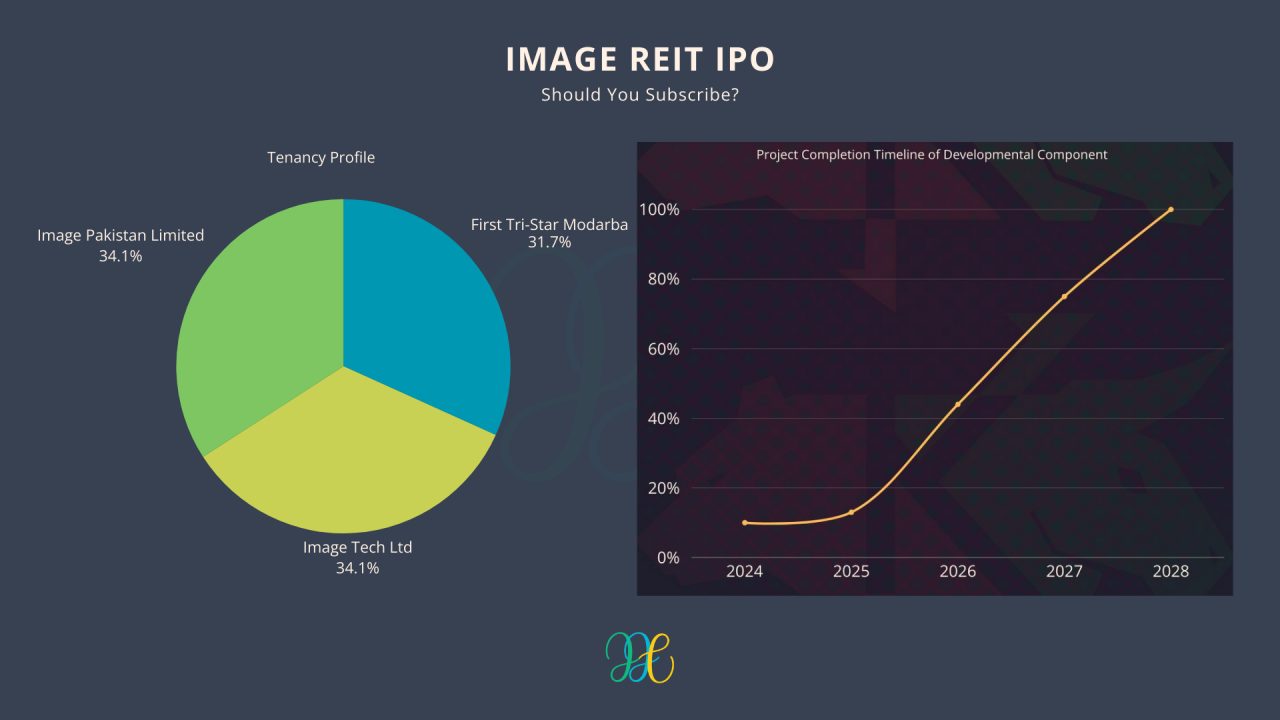

Here is the rental revenue breakdown:

The revised rents will be raised by 10% annually. However, they were raised 2.5x this year alone before the IPO, which is worth investigating further as to their consistency with neighboring properties. Unfortunately, I don’t have the time for that.

It is worth noting here that all the tenants are related parties. In other words, the building is occupied by companies of the same group. Even in the developmental component of this REIT, which we will look at in detail later, the rent is coming from Image Pakistan Limited, a related party.

This does raise the question of how reliable these cash flows are. If the REIT is receiving rent from its own companies, what is stopping them from waiving off the rent or not paying on time? While these transactions are expected to be conducted on an arm’s length basis(which assumes dealings as if the two parties were independent), investors still cannot ignore the risk.

It is also worth noting that with the freshly revised rents, Image Pakistan Limited is paying 38.2 million in rent to Image REIT. This is nearly 10% of the company’s profit after tax (PAT). Also worth noting that the free cash flow to the firm is negative, -552 million against the 38.2 million rent that Image Pakistan is supposed to pay to Image REIT.

Similarly, First Tri-Star Modaraba’s Profit After Tax is 1.6 million against the rent of 7.47 million it will pay to Image REIT.

2. The developmental component:

The developmental component of the REIT is an under-construction building on Tipu Sultan Road, Karachi. The first two floors are already completed and rented out to Image Pakistan, while the remaining floors will be completed by 2028.

Upon completion, the building will serve dual purposes. 9 floors will be sold out to generate income for the REIT, while 2 floors will be rented out. There are two apartments on each floor.

The first two floors, which are currently rented out to Image Pakistan, will be sold to Image Pakistan upon completion of the building. That sale is expected to generate PKR 434 million.

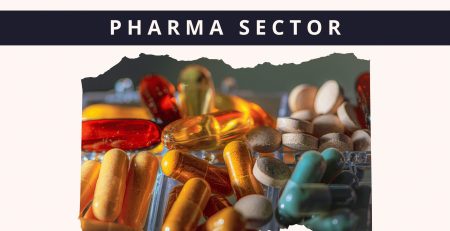

When will the floors be completed?

The ground, mezzanine, and first floor are already complete. The floors 2-5 are expected to be completed in 2026, floors 6-9 in 2027, and floors 10-11, together with all the finishing work, are expected to be done by 2028.

The developmental component is also currently generating rental income, as shown below:

It is worth asking at this point as to why the company isn’t selling the first two floors right now to generate the funds for the project. There could be many good reasons that I am unable to figure out, but it wouldn’t make sense for the company to generate funds from its own company. The fact that 100% of the revenue is being generated from related parties makes it hard to figure these things out.

Will Image REIT pay a dividend?

Now we come to the question that every retail investor wants to know the answer to. Will Image REIT pay dividends? Will they be as consistent as DCR?

First, we need to make an important distinction here. It is often said that REITs are required to pay out 90% of their income. This is not true. This isn’t a requirement. It only allows them a tax exemption. So yes, they can keep all the rent as income and pay tax on it and not pass it on as a dividend. That can happen.

Secondly, the 90% applies only to the accounting income, not the EPS. In this case, the REIT’s EPS down the road will also contain a part from the revaluation of its properties. Since that is paper gain, it cannot be paid out to shareholders anyway. We’ll shortly look at the forecasted cash flows to get an idea about this.

In its prospectus, the REIT promotes both the rental revenue as well as revenue from the sale of properties in the future. The rental portion is expected to contribute to regular dividends from the beginning. It currently generates PKR 34.4 million in rent (9MFY25), which amounts to about PKR 0.12 per unit.

Here is how the cash flow projections look:

The company expects to pay out PKR 66.8 million in FY26. This corresponds to PKR 0.24, a 2.4% dividend yield for IPO investors at best(IPO at PKR 10) and 1.7% at worst (IPO at PKR 14).

In FY28, the dividend is expected to reach PKR 1.28 per unit.

Note that the FY28 dividend incorporates the proceeds from the expected sale of the property in 2028.

Where the IPO proceeds will be utilized:

Image REIT will spend 88% of the IPO proceeds on construction costs with only 5% for contingencies.

This is where the risk of the real estate market comes in. Any delays in construction or increase in construction cost will need to be funded from the rental income, which will affect dividends. Similarly, a delay will also mean the capital gain expected from selling the developmental part is delayed.

Post ipo free float

After the IPO, 33.36% of the total outstanding units will be with the public. 51.2% ownership will remain with Mr. Asad Ahmed, and 15.44% with First Tri-Star Modaraba.

Image REIT will certainly be welcomed in the market in the ongoing bullish rally. If the company can balance the rental component with timely delivery on the developmental part, this REIT could help bring stability to many income-focused portfolios.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply