What to expect from Pakistan State Oil (PSO) Q2 earnings

AKD Securities has just published a report on PSO’s Q2 earnings expectations. The firm expects PSO to post a PAT of PkR8.4bn, corresponding to EPS of Rs. 17.9.

Pakistan State Oil (PSO) is expected to report robust earnings for 2QFY25E with an estimated PAT of Rs. 8.4 billion (EPS PKR 17.9). This marks a significant turnaround from the LAT of Rs. 14.1 billion (LPS: Rs. 30.1) reported last year. The anticipated improvement is supported by the following key factors:

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Firstly, PSO is expected to incur no inventory losses in this quarter, which affected the previous year’s results. This change is expected due to improved inventory management and aligning procurement strategies with market demand.

Secondly, firmer core operations are shown by PSO’s higher volumetric offtake. The quarter saw the company deliver total volumes of 2.0 million tons, 7% YoY growth in motor spirit (MS) and high-speed diesel sales. So much of the growth is due to robust demand and better distribution efficiencies.

Thirdly, PSO probably will have a good, delayed payment income on overdue gas receivables from Sui Northern Gas Pipelines Limited (SNGPL). During the quarter, this income will serve as a huge source of income for the company which will contribute in large to the company’s earnings.

📢 Announcement: We're on WhatsApp – Join Us There!

Finally, the bottom line can get even better because of the lower finance costs. Finance costs might be down 33% YoY driven by a fall in short-term borrowings (down Rs. 48 billion) as well as reduced lending rates on foreign exchange as well as domestic borrowings. It will help PSO to alleviate its operating cash flow pressure.

According to the AKD research, the DPS for the quarter is expected to be declared at Rs. 7.5 per share, as the company is expected to report better performance and will reward the shareholders.

For December 2025, AKD Research has kept a ‘Buy’ rating on PSO and TP Rs. 729 per share (129%) vs the last close. Given its improved earnings outlook, the stock is an attractive investment on the back of an attractive dividend yield of 5.1% for FY25E.

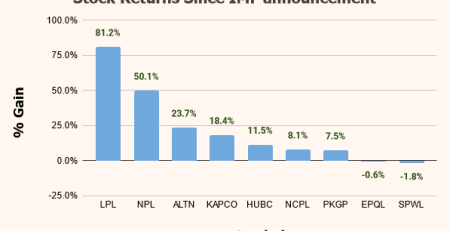

What are the analysts saying?

According to our database, PSO is covered by 8 different analysts with an average Dec 25 target price of Rs. 514. This includes the lowest target price of Rs. 362 by Arif Habib and the highest target of Rs. 729 by AKD Securities.

Here is how different analysts have set their Dec 2025 target prices for PSO:

| Research Firm | Target Price (Dec 25) |

|---|---|

| AHL | 362 |

| AKD | 729 |

| IGI | 448 |

| JS | 675 |

| Intermarket | 400 |

| Taurus | 410 |

| Al Habib Capital | 550 |

| Pearl | 540 |

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (3)

Changing oil doctrine mentioned in Trump’s address at inauguration plus end of Houthi attacks after Gaza war is over, These two points must be factored in as determinants of oil prices. Foresee 375-400 as Dec 2025 target price if political situation of Pakistan remains stable.

PSO and OGDC safe investments for 2025

Very attractive investment at current levels.