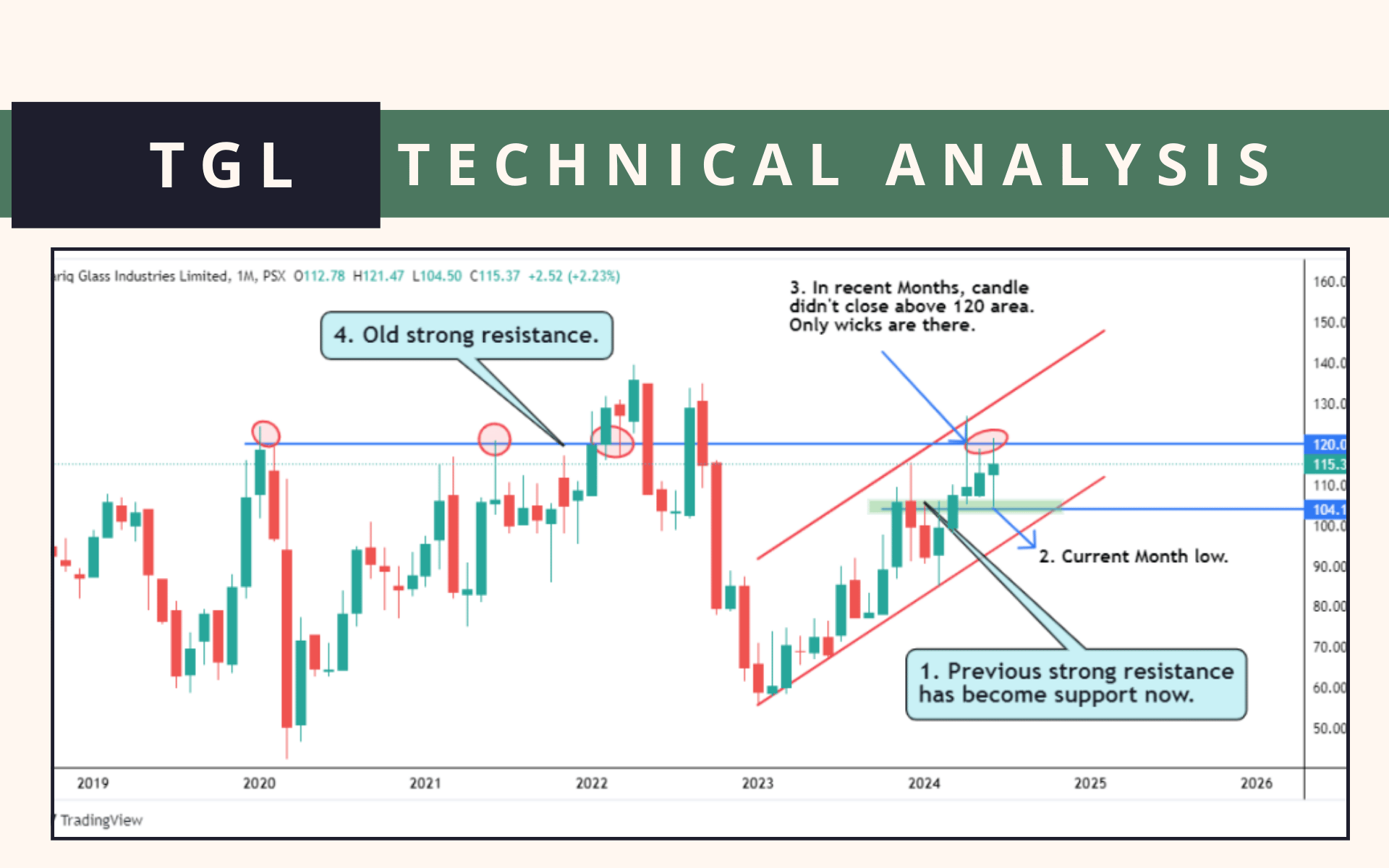

TGL bossing the glass sector

Tariq Glass Industries Limited (TGL) is eagerly trying to break the 120 area of monthly resistance. See it’s just created a monthly lower wick (104) and then again come back to the range.

In Weekly time frame TGL, is in range. But overall trend is bullish. These red lines are my channel.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Which is showing higher high and higher low market structure.

Accumulation from 117 ~ 108. If take more dip (that) then 104.

TGL has edge over their competitors. Sales are increasing and different business model.

📢 Announcement: We're on WhatsApp – Join Us There!

In Daily time frame, Stock has little gap up opening. It might fill the gapor not nothing is certain.

One could take half position and hold half as a cash. Once you get chance from down move add more quantity.

If it closes below 100 trend would change.

Reminder, 127 is 52 week high area.

Selling would be witnessed and if sustained above 125 area, next good area for sellers are

129 – 132 – 135.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (2)

keep up the good work

Thank you.