Shifa International (SHFA) has returned 150% in two months, will the rally continue?

Shifa International Hospital, a leading healthcare facility situated in Islamabad, has attracted investor attention recently.

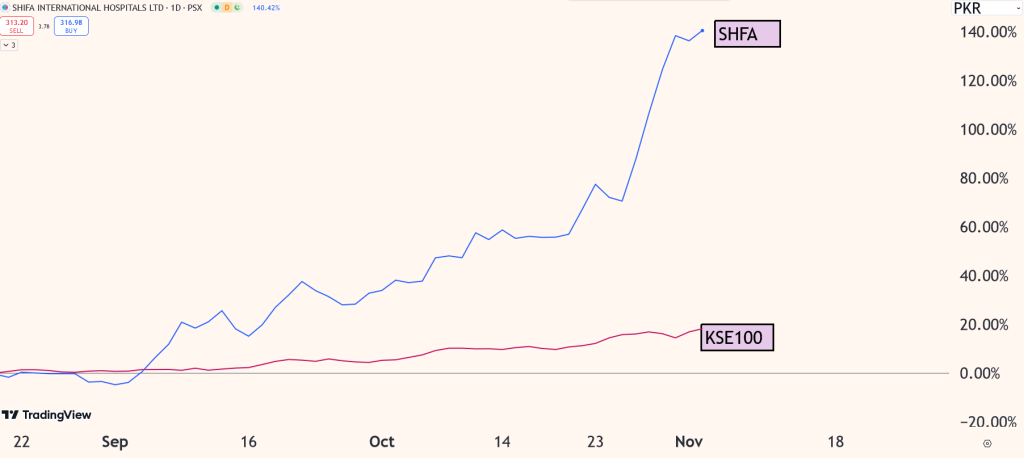

Since the start of September, the KSE100 index has returned 17% while SHFA has given a massive 150% return. What has caused this surge in stock price and is the stock still a buy?

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Impressive financial performance

The stock price started rising in the build-up to the company’s annual results. A 19.5% increase in revenue and a 15.% increase in profit after tax was enough to convince the public that the rally was justified.

Let’s also not forget that in the first quarter of fiscal 2024, the company did not report any significant YoY growth in EPS, despite an impressive topline performance.

Improving operational efficiency

If the company’s operational performance had really improved as much as the management claimed in the annual report, the first quarter was bound to show better numbers. And that’s what happened.

📢 Announcement: We're on WhatsApp – Join Us There!

A topline growth of 19% translated to a 60% growth in profit after tax. As a result, the stock price now stands at around Rs. 315, a 150% increase from the start of September.

Here is what the management has said about the operational efficiency of the company’s operations:

A new specialized medication administration unit has been established in the Neurosciences building DUS, allowing for more direct patient care and better overall service delivery. Additionally, new OPD phlebotomy points have been set up across the OPD to streamline patient services.

The upgraded EMR (Electronic Medical Records) system now features advanced tools…The system also enhances operational efficiency, reduces errors, and boosts patient satisfaction, aligning with the hospital’s care and operational goals.

Switching to a web-based OPD appointment and registration system has made services more accessible and efficient. This change has also enabled the integration of a WhatsApp chatbot…

Several cost-optimization initiatives have been launched to maximize resource use and improve financial efficiency. One key project is the implementation of the Floor Stock Module, whichoptimizes supply levels across the OPD. The initiative helps better manage supplies, reduce waste, and track resources systematically, leading to cost savings.

These initiatives highlight the organization’s commitment to process automation, capacity utilization, and patient-centered care, which are key components of the hospital’s strategic planning for the upcoming fiscal year

The company’s expansions aside, the above highlights the fact that it is committed to improving its existing operations while expanding its offerings.

Debt management

Apart from the top and bottom line growth, SHFA has also managed its debt levels well.

From total liabilities of approximately Rs. 7.65 billion in 2023 to total liabilities of Rs. 6.3 billion in 2024, the company has reduced its debt by 17.6% at the unconsolidated level.

Moreover, the long-term debt Is just Rs. 0.58 billion. This is perfectly in control considering the Rs. 2.15 billion in cash and bank balances. This also supports the hospital’s Faisalabad expansion plans.

Most of the liabilities are included in the Rs. 4.16 billion in trade payables. With trade receivables just at Rs. 1.35 billion.

Valuation

With the share price reaching multi-year highs, it is worth asking if the stock is still worth buying. Many people would step away looking at the recent rally and how high the price is. But it is worth looking at the price in a historical context.

The stock has historically traded at a PE of 10 during moderate market conditions while it has traded at a PE above 20 during bull rallies.

The current trailing PE of the stock stands at around 15, which would suggest it is in the midpoint of historic highs and lows.

However, markets are forward-looking and it is important to price the stock for its next year’s earnings. What are we expecting the company to earn in the next three quarters?

Upside

If the company continues its first-quarter performance for the rest of the year, its EPS would be around Rs. 40 for the year. A PE multiple of 20 would price the stock at Rs. 800.

That, however, is unrealistic considering the company’s historic growth rate. A more realistic growth rate would be a 40% improvement in bottomline. This would mean an EPS of 28, which at a PE of 20 stands at around Rs. 560.

Downside

The above of course assumes no serious political or economic headwinds. In a downside scenario, if the company only grows its EPS at 20%(EPS = Rs. 26), then even the worst case scenario of PE=10 prices the stock at Rs. 260.

This means the stock still has minimal downside. Any improvement in its operations, expansion, or market conditions should cause the stock to continue rallying further. This means even at multi-year highs, the stock is still worth buying.

Where will the growth come from?

The hospital is committed to further enhancing its operational efficiency through process automated. Maximizing existing service capacity and increasing that capacity is also going to result in significant growth.

Key projects include expanding lab testing points within the hospital, automating processes at in-house OPD pharmacies to reduce waiting time, and streamlining inpatient discharge processes.

Annual FY24

At a bed occupancy ratio of 62%, there is a lot of room for growth if operational efficiency is improved.

It also plans to hire more consultants, expand the specialties covered and provide services on Sundays and other holidays. Even though OPD consultation isn’t the most profitable part of a hospital’s business, increased consultations result in growth in lab tests and diagnostics, where the real profitability lies.

Plans for the upcoming year also involve hiring new consultants across various specialties, extending services to evenings, Sundays, and holidays,relocating OPD areas to improve patient flow, adding more inpatient beds, and introducing specialized services like PET scans, EBUS, and expanding Endoscopy services.

Establishing occasional setups in neighboring cities also brings in referrals to the main hospital. The company already does this and plans to expand its outreach further.

Shifa National Hospital Faislabad’s construction is also in progress. While there will be no financial impact of this new facility in FY2025, it will likely play a part in the stock’s valuation.

Technical perspective

It can be seen that the stock has broken its previous resistances on the log scale chart.

As long as the stock price sustains above the Rs. 324 level, traders shouldn’t fear any downside in the stock.

To conclude, the company’s finances look healthy and the growth plans seem to be on track. Assuming no non-systemic headwinds, the stock price still has more room to grow.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (4)

Is there any other hospital listed on psx?

No. This is the only listed hospital in the PSX.

Good analysis.

What is the revenue per available bed at Shifa?