How to analyze pharmaceutical sector

- Brief overview of a pharmaceutical company's business

- Pakistan's pharmaceutical market

- Challenges Facing Pakistan's Pharmaceutical Sector

- Is Pharma a cyclical sector?

- Understanding Pharmaceutical companies' margins

- Why are generic medicines priced differently when they're all the same?

- Working capital requirements in pharma industry

- Why are pharma multinational companies (MNCs) leaving Pakistan?

- Do Complementary and Alternative Medicines (CAM) pose a threat to the pharma industry?

The global pharmaceutical industry is highly regulated. Its workings are complex, as it can take several years to develop new drugs, which must undergo strong ethical, legal, and regulatory compliance before they can be sold in the market.

Key activities of the pharma industry encompass research & development (R&D), manufacturing, marketing, and sales of drugs.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

In Pakistan, there is less focus on R&D and companies are more focused on manufacturing, marketing, and sales of drugs.

Brief overview of a pharmaceutical company’s business

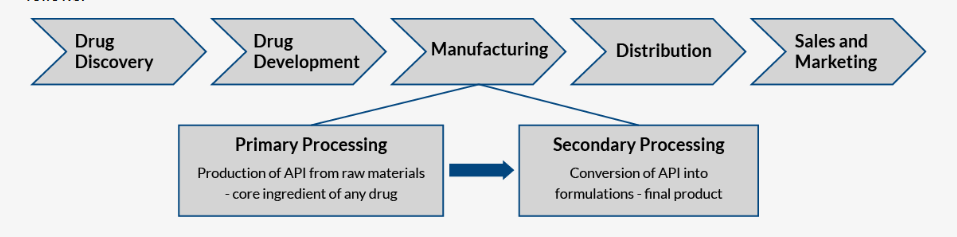

Here are the steps involved in the making and selling of medicines.

The process of making and selling medicines involves several important steps:

- Drug Discovery: This is the first step where scientists discover new substances for treating diseases.

- Drug Development: After discovering a promising substance, it goes through tests and trials to ensure it’s safe and works effectively.

- Manufacturing: Once the drug is approved, it’s produced in large quantities. This includes two main processes:

- Primary Processing: In this step, the core ingredient of the medicine, called the Active Pharmaceutical Ingredient (API), is made from raw materials. The API is the main component that makes the drug work. In Pakistan, over 80% of APIs are imported.

- Secondary Processing: The API is then turned into the final product, like tablets, syrups, or capsules, that we see in the market. This is the manufacturing that is mainly carried out in Pakistani pharmaceutical companies.

- Distribution: The finished medicine is sent to pharmacies, hospitals, and other healthcare centers.

- Sales and Marketing: Finally, the medicine is sold to consumers, with efforts to educate doctors and the public about its benefits.

📢 Announcement: We're on WhatsApp – Join Us There!

In Pakistan, there is hardly any focus on drug discovery and drug development, though the industry is improving with time.

One can also call drug discovery and drug development companies innovator companies and drug manufacturing companies as generic manufacturers.

In Pakistan, the pharma business is dominated by generic manufacturers, which means rather than competing to discover the best medication, they focus on manufacturing existing medications and then competing on conventional dimensions of efficiency and price.

Pakistan’s pharmaceutical market

In Pakistan, the pharma industry is dominated by generic manufacturers, which cater to 70% of the country’s pharmaceutical needs. The other 30% is either represented by imported medicines or multinational companies manufacturing their patented drugs locally.

Most of the market is controlled by local or national companies, making up about 67% of the total revenue

The top 10 companies in the local market held about 48.7% of the market share in the pharmaceutical sector in 2023. This means nearly half of the money in this sector was earned by these 10 companies. The remaining 51.3% came from all the other companies combined.

Here are the top 10 pharma companies in Pakistan.

| Company | National/ Multinational (MNC) |

|---|---|

| Getz Pharma | National |

| Sami Pharmaceutical | National |

| GlaxoSmithKline Pakistan | MNC |

| Abbott Laboratories Pakistan Ltd. | MNC |

| The Searle Company | National |

| Martin Dow Ltd. | National |

| Hilton | National |

| OBS | National |

| High-Q International | National |

| Haleon Pakistan Ltd. | MNC |

The total market size stood at Rs. 748 billion in 2023. It is expected to reach the Rs. 1 trillion mark by 2025.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Total Market | 422,919 | 471,397 | 559,777 | 655,059 | 748,072 |

| National | 296,174 | 330,368 | 396,638 | 472,622 | 546,639 |

| MNCs | 126,744 | 141,029 | 163,139 | 182,436 | 201,432 |

Here are the top 10 pharmaceutical brands in Pakistan

| Rank | Pharmaceutical Brand |

|---|---|

| 1 | Ceftriaxone |

| 2 | Paracetamol |

| 3 | Esomeprazole |

| 4 | Metformin + Sitagliptin |

| 5 | Cefixime |

| 6 | Omeprazole |

| 7 | Amoxicillin + Clavulanic Acid |

| 8 | Ciprofloxacin |

| 9 | Diclofenac |

Export of pharmaceuticals from Pakistan

Even though Pakistan is becoming better at improving its regulatory infastructure, it still needs to do a lot of work to become a relevant exporter of pharmaceuticals in the world.

For now, Pakistan exports most of its pharma products to countries that aren’t as heavily regulated as the US and Europe.

Here are the total pharma exports of Pakistan in the last 5 years.

| Financial Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Exports (USD million) | 212 | 210 | 270 | 269 | 328 |

Import of pharmaceuticals into Pakistan

As previously mentioned, Pakistan imports over 80% of the APIs that are used in making the desired drugs.

As of Jan’24, ~23 pharmaceutical manufacturers hold licenses to produce APIs. These companies together cater ~15.0% of API production, with the remaining 85.0% being imported.

PACRA Research

Here are Pakistan’s total pharma imports in the last 5 years.

| Financial Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Imports (USD million) | 1,093 | 997 | 1,390 | 4,063 | 1,329 |

It is pretty clear that Pakistani pharma’s import bill is much higher than its exports. This is what makes the industry so vulnerable to currency devaluation and inflation.

Regulatory Framework

Pakistan’s pharmaceutical sector is controlled by two main bodies: the Ministry of National Health Services Regulations & Coordination (NHSR&C) and the Drug Regulatory Authority of Pakistan (DRAP).

DRAP is the main authority that oversees the registration of new medicines (both local and imported) and new manufacturing sites.

All pharmaceutical imports require approval from DRAP, which also sets the Maximum Retail Price (MRP) for all medicines sold in Pakistan.

Recent developments regarding de-regulation of non-essential medicines

In May 2023, the government allowed a one-time increase in MRPs for essential drugs by up to 70% of the Consumer Price Index (CPI), capped at 14%, and for non-essential drugs by CPI capped at 20%.

This adjustment was seen as insufficient given the industry’s long-standing grievances regarding fixed prices amidst rising costs.

In February 2024, the government deregulated prices for non-essential medicines and approved higher MRPs for 146 essential drugs.

Challenges Facing Pakistan’s Pharmaceutical Sector

While the pharma sector has seen impressive growth with an average annual increase of over 15% in the last five years, it has struggled to achieve international recognition. There are a number of reasons for this:

1. Dominance of Big Companies

A few large firms heavily control the sector. The top 10 companies hold a significant share of the market, which limits competition.

If a small company tries to innovate and launch a new drug in Pakistan, the bigger players can outspend it to launch their own version of the drug. For this reason, there is hardly any innovation in the sector.

2. Strict Price Controls and Regulations

The government tightly regulates pharmaceutical prices in Pakistan. These heavy restrictions have driven many multinational companies (MNCs) to leave the country since 2010. The departure of these MNCs has negatively impacted the local industry, reducing efficiency, technology upgrades, skills, and overall investment.

Even though pricing controls are slowly lifting, the government still has a major say in controlling drug prices, which makes it hard for companies to improve their profitability in a worsening economy.

3. Local Focus Due to Weak Intellectual Property Rights

Due to loose intellectual property laws and government price controls, multinational companies prefer to serve the local market rather than exporting from Pakistan. Many do not seek approvals from stringent international regulatory bodies, which would allow them to sell their products globally. This has resulted in fewer innovative medicines being introduced to the Pakistani market.

Is Pharma a cyclical sector?

In the PSX, the Pharmaceuticals sector is considered a complicated sector to invest in.

However, the demand for pharmaceutical products has nothing to do with the state of the economy.

In developed countries, where the healthcare cost is mainly paid by employers through insurance companies, revenues can fluctuate with the employment rates.

In a country like Pakistan, that is not the case and companies cater to increasing demand every year, which reflects in their revenues.

Expenditure on healthcare is one of the factor contributing to growth of the pharmaceutical sector. Expenditure on

VIS Rating

healthcare in Pakistan has been increasing steadily over the years

Understanding with an example

Take Highnoon (HINOON) as an example. Here is the data for the company from 2020 to 2023.

| Year | Revenue (bn) | EPS | Net margins |

|---|---|---|---|

| 2020 | 10.28 | 42.58 | 13.28 |

| 2021 | 13 | 48.76 | 13.91% |

| 2022 | 15.8 | 59.04 | 15.28% |

| 2023 | 19.4 | 46.2 | 12.37% |

HINOON was able to increase its revenues at a considerable pace from 2020 to 2023. Pakistan’s economy went through multiple crises during these years, including COVID-19 and the overthrowing of Imran Khan’s government.

If a company can generate more sales regardless of the economic conditions, then it is a stable business. However, stability is seldom associated with pharma stocks. And there is a good reason for that.

In the case of HINOON, notice how the company’s margins dropped significantly in 2023 compared to both 2022 and 2021.

From 2021 to 2023, the company’s revenue went up by 50% but its EPS went down from 48.76 to 46.2.

This is how margins can destroy a company’s profitability(though margins aren’t always the only reason). This is what makes pharma a difficult sector to work in, even though its revenues are as stable as those of fertilizer or power companies.

Understanding Pharmaceutical companies’ margins

To understand what determines the health of pharma companies’ margins, we need to see how the industry is regulated.

In Pakistan, the categorization of medicines into essential and non-essential categories is regulated by the Drug Regulatory Authority of Pakistan (DRAP). This classification impacts not only pricing but also the availability and accessibility of medications for the population.

Pharma companies are not allowed to increase the prices of essential medications at will. Instead, they need to follow specific rules set out by DRAP, which are usually tied to CPI numbers.

In short, the companies can only raise the prices approximately by the same amount as the inflation determined by the government. This means they do not have pricing control over the products they sell(which makes them an unattractive investment to many)

Essential vs non-essential medicines

Essential Medicines are those that satisfy the healthcare needs of the majority of the population. They are included in the National Essential Medicines List (NEML) and are typically life-saving drugs or those used to treat common conditions.

According to DRAP guidelines, pharma companies can increase the Maximum Retail Price (MRP) of essential drugs by a maximum of 14% based on inflation rates, specifically capped at 70% of the Consumer Price Index (CPI) increase.

Non-essential medicines, on the other hand, include all other drugs that do not fall under the NEML. These medications are subject to less stringent pricing controls, allowing companies to raise prices based on CPI increases capped at 20%.

In the second half of 2024, the government has eased regulation on drug price increases allowing companies to raise prices of non-essential medicines. This is expected to ease off the pressure on pharma margins due to rising costs and devaluation.

Impact of Rupee devaluation on margins

Since pharmaceutical firms import over 80% of the APIs that are used in making these medicines, rupee devaluation negatively impacts their costs, and hence their margins.

The gross profit margin for pharmaceutical companies fell from 30% in 2022 to 26% in 2023. This was a time when the rupee was facing rapid devaluation and imports were restricted.

Impact of inflation on margins

Alongside currency devaluation, companies faced an average inflation rate of 31% and a substantial rise in finance costs, which surged by 55%, amounting to approximately Rs7.7 billion in 2023.

Selling and administrative expenses also rose sharply, contributing further to squeezed margins

Why are generic medicines priced differently when they’re all the same?

If all generic drugs are similar in terms of their therapeutic effect on the body, why do some sell for a higher price? The answer lies in brand power.

Pharma companies know that their products are non-differentiable.

Non-differentiable products are prone to price wars, which result in lower margins for companies. In order to overcome this problem, many pharma companies give a name to their generic medicine and then promote it as a brand, which helps them sell the medicine at a higher price.

Panadol is an ideal example of this. Even though there are hundreds of medications on the market that contain paracetamol, we always ask for panadol when buying the medicine at a pharmacy. This is called brand power. Panadol is etched in our brains and we do not trust any alternatives, even though they are all the same.

Here is the selling price for panadol and other paracetamol-containing medications in the Pakistani market.

| Brand name | Manufacturer | Retail price (approx) |

|---|---|---|

| Panadol | GlaxoSmithKline | 30 |

| Paracetamol | Ferozsons Laboratories | 14 |

| Disprol | Reckitt Benckiser | 28 |

| Normidol | Shaheen Agencies | 20 |

| Painol | Karachi Pharmaceuticals | 12.5 |

| Paramol | Euro Pharma International | 17 |

| Pedrol | Stanley Pharmaceuticals | 17 |

As can be seen in the above table, the power of a brand is not to be underestimated.

If a company is able to give the perception that its generic medicine is more reliable than other generic ones in the market(through marketing), it can easily increase the selling price, thus increasing its margins.

To add some context about the domination of brands, 22% of the total industry revenue is generated by the top 10 brands!

In some cases, the same manufacturer produces two medications that are exactly the same but branded differently and as a result sold at different prices.

In other cases, pharma companies can outsource the manufacturing of the medication to a third-party. This third party usually makes the same drug for multiple pharma companies, who then brand it differently and sell at different price points in the market.

As a result of this brand power, it is often the case that the higher price drug also enjoys the highest market share.

However, it is also worth contemplating that because of the higher margins, pharma companies can better reward pharmacies to prioritize selling their branded medication as opposed to a cheaper alternative. This helps them keep the highest market share despite being expensive.

Working capital requirements in pharma industry

Pharmaceutical companies in Pakistan typically need to maintain three to six months of stock to meet their working capital requirements.

This inventory level is crucial for ensuring that they can manage production schedules, fulfill orders, and respond to market demands without interruption(for example when there is restriction on imports or API is not available).

Maintaining a stock of three to six months allows pharmaceutical companies in Pakistan to balance operational needs with financial health effectively. DRAP regularly enforces this requirement so that a consistent supply of medicine to the market can be ensured.

Why are pharma multinational companies (MNCs) leaving Pakistan?

In Pakistan, Multinational Companies (MNCs) were once considered giants in the pharmaceutical and research sectors. They invested heavily in research and development (R&D) for the creation of new drugs.

The number of MNCs in Pakistan kept growing until the 1990s, after which a gradual decline began. Today, the number of MNCs has dropped from 40 to just a handful of companies. Most recently, companies like Pfizer and Sanofi have exited Pakistan.

Reasons Behind the Decline of MNCs

There are several reasons for the decline of MNCs.

One key factor is the rise of local companies, which improved their business practices and gained a larger share of the market. Local firms provided doctors with more options for prescribing medications and offered better salary packages, attracting skilled professionals away from MNCs.

Another significant reason was the government’s “price freeze” policy on medicines, which was in effect from 2001 to 2013. This policy kept medicine prices fixed while production costs continued to rise, squeezing MNCs’ profit margins.

As a result, their Return on Investment (ROI) dropped, making it harder to maintain their usual high-quality standards. This pushed MNCs to look for other markets, such as Bangladesh, where regulations are less restrictive and production costs are lower.

Another major challenge for MNCs was the lack of enforcement of Intellectual Property (IP) rights in Pakistan. This allowed local companies to easily produce generic and cheaper copies of branded medicines, creating tough competition for MNCs.

Additionally, the local pharmaceutical industry made significant progress in terms of quality and diversity of products, making it even harder for MNCs to keep up.

Why MNCs Matter and the Need for Their Return

Many believe that the departure of MNCs from Pakistan should be reversed, as they offer unique advantages that local firms often cannot match.

MNCs are known for providing high-quality training to their staff in world-class institutions, which boosts the skills and capabilities of the industry as a whole. Therefore, it’s crucial for both the government and the industry to collaborate and create an environment that encourages MNCs to reinvest in Pakistan.

Do Complementary and Alternative Medicines (CAM) pose a threat to the pharma industry?

In Pakistan, alternatives medicines like homeopathic, ayurvedic, and unani tibb have always been famous from a historical perspective.

In rural areas, where the tendency to use conventional medicine and access to hospitals is still not great, people continue to rely on these alternatives.

Despite this, these alternates pose little threat to the pharma industry. Here’s why.

- Small Market Share: CAM holds only a minor portion of the overall healthcare market.

- Strong Pharmaceutical Presence: Established pharmaceutical companies have substantial resources for marketing and human resources, far outstripping CAM producers.

- Lack of Capital and Scale: CAM providers don’t have the financial power or infrastructure to compete with mainstream pharmaceuticals.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (13)

Very useful insights sir

Jabran sb, nice effort to spread financial literacy. appreciated your efforts. Stay blessed. Many things/points to learn about pharma sector in tihs article.

Assalamualaikum

Sir I am new to PSX and at learning stage. I am very happy to read this well researched analysis of pharma sector. It will help a lot to retail investor. I got value from this blog post. Please keep sharing your knowledge. I am posting comments just to commend your efforts. Please keep sharing similar analysis on other sectors of PSX. Thanx

Thank you for your appreciation and I’m glad the post helped you.

I am new to investing in the Pakistan Stock Exchange (PSX) and currently hold shares in the fertilizer and oil exploration sectors. I am looking for long-term value investments with the best potential for ROI. Could you provide your assessment of the pharmaceutical sector in the PSX, specifically focusing on the following:

1. Sector Fundamentals: How is the pharmaceutical sector expected to perform given current economic conditions, regulatory changes, and healthcare trends in Pakistan?

2. Key Players: Which companies, such as GlaxoSmithKline, Searle, and Abbott Pakistan, demonstrate the strongest financial health, consistent growth, and competitive advantage?

3. Valuation: How do the current P/E ratios and dividend yields of leading pharma stocks compare with historical trends and the overall market average?

4. Risks and Challenges: What are the major risks, such as currency devaluation, raw material shortages, or regulatory changes, that could impact profitability in this sector?

5. Recommendations: Based on your analysis, which specific pharma stocks would you recommend for long-term investment, and why? What should be the ideal entry and exit points, considering my goal of maximizing ROI over the long term?

Hi Salman, the regulatory pressure is easing and there is potential for companies that have a big portfolio of non-essential medications. Also, the API market can be very big if companies start manufacturing APIs in Pakistan. This is another aspect investors should keep a close eye on.

Risks like currency devaluation and harsh regulation have eased off. As long as raw materials can be easily imported, there don’t seem to be any major headwinds for this sector.

We do not recommend stocks. However, in the recent months, stocks with a bigger percentage of non-essential medicines have performed better. The sector enjoys high PE ratios so valuation will always look high compared to other sectors in PSX.

Thanks for the response 👍👍

Interesting info: “In some cases, the same manufacturer produces two medications that are exactly the same but branded differently and as a result sold at different prices.”

This highlights a key practice in the pharmaceutical industry. Companies often produce identical medications under different brands, like GlaxoSmithKline’s Panadol and Calpol, and sell them at varying prices. While it broadens market reach, it can confuse consumers. Transparency and education are crucial to help patients make informed, cost-effective choices.

Dear for your information I would like to share that panadol was manufacturing smithkline bechem & calpol was manufacturing wellcome they were two different mnc but globally & locally both companies merged therefore now one company formed by the name of GlaxoSmithKline promoting these two products but later GlaxoSmithKline Kline sold this brand to haleon (formerly Sandoz)

Why is BFBIO going so high since IPO?

There is a lot of hype surrounding its weight-loss drug (Semaglutide).

Thanks for sharing information which is a good way to learn about a sector. Is pharma worth long term investment?

Yes it is. But it requires vigilance as you have to keep a close eye on devaluation, inflation and API availability as they determine the profit margins. Also look at each company’s product portfolio.

A strong product portfolio, strong product pipeline, and a good percentage of non-essential medicines in portfolio are a few things you should look at.