FCCL a little rocket for your portfolio

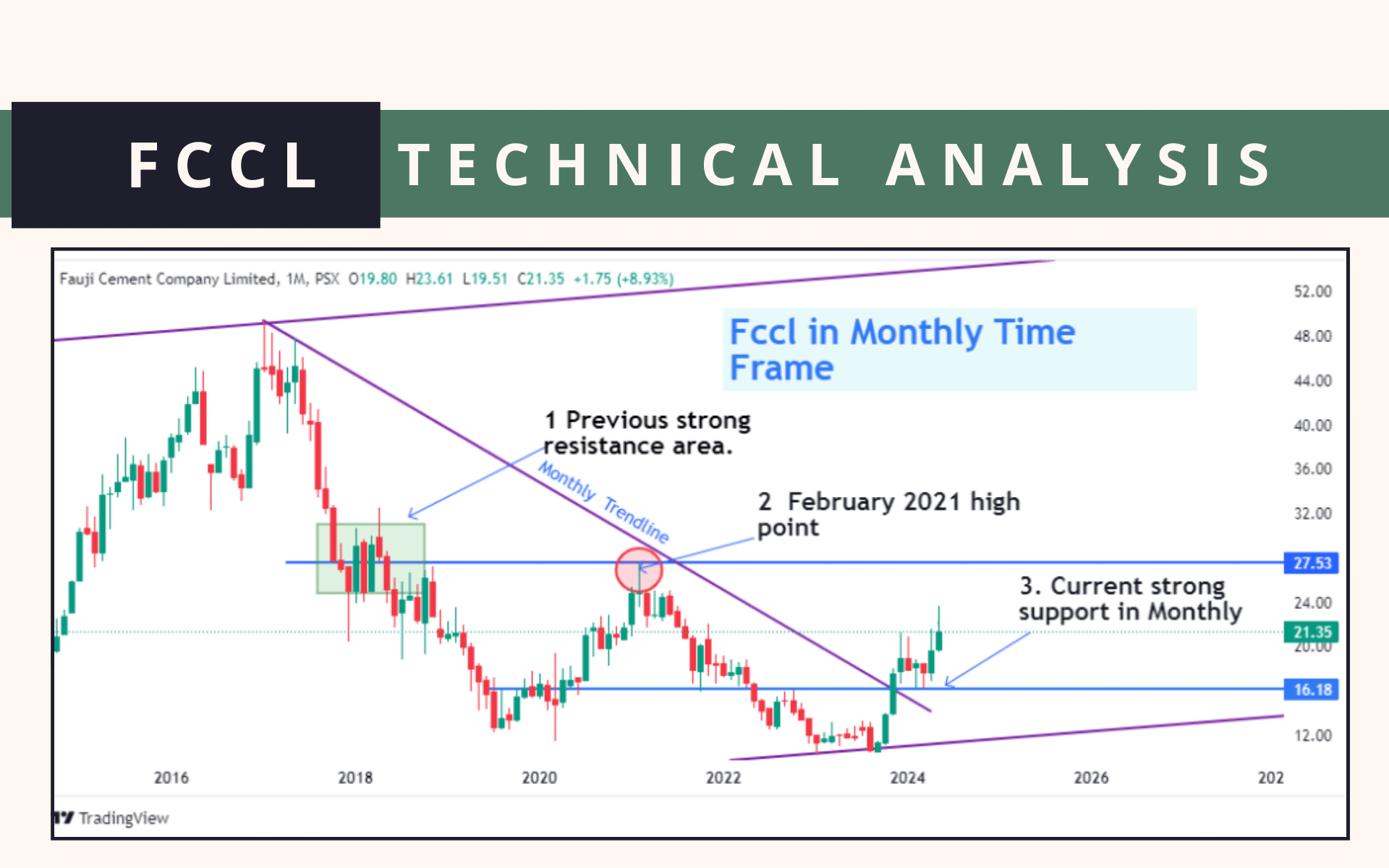

Fauji Cement Company Limited (FCCL), In monthly time frame its market structure is printing continuously higher high and higher low.

This script still has more potential to upside, from 20 to 35 we can see this in future time.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

FCCL is expanding the Nizampur site in Khyber Pakhtunkhwa and the DG Khan site located in Punjab. After this, FCCL will be the second largest player in North and third largest player in the country.

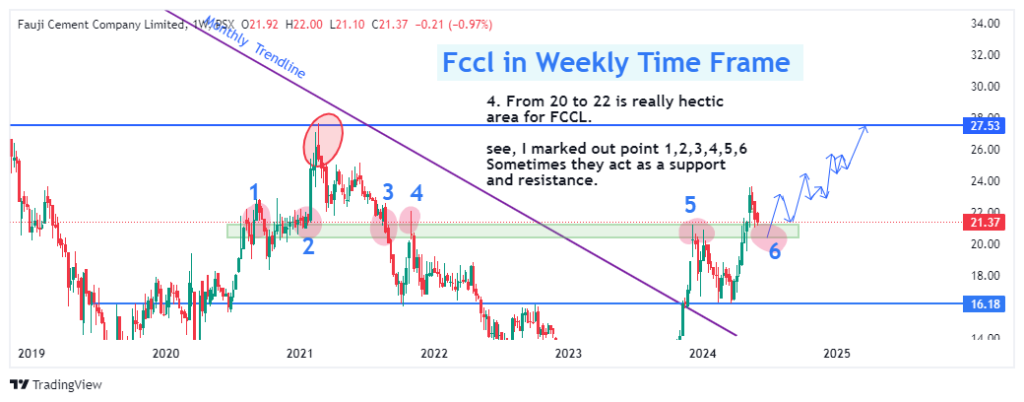

In Weekly time frame FCCL is showing us the importance of levels from 22 to 20.

In daily the clear picture is saying that its time to accumulation of this stock.

📢 Announcement: We're on WhatsApp – Join Us There!

From 21 to 19 is good range for buyers.

it should not break 17 level then trend will change.

Sell half, and hold half strategy. In 25~ 27 area.

Different research analyst targeting different prices of Fccl like 28, 30, 32, 36.

But from levels to levels profit taking could be good approach.

Closure above 28 will leads to 30 ~34.

Disclaimer

Always take trade with your own risk appetite.

Before taking any trade do your own research first.

Financial markets are very risky, you need to learn to earn.

For more queries you can contact me on my instagram page Simplemarket11

Have a Happy Trading journey.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comments (2)

AOA,

I have unity food and Panther Tyres in my portfolio. My buying of unity food is @ 28.00 and Panther tyre @ 56.00. The current price of unity food is 26.66 and of Panther tyre is 38.45.Should I sale or not? What you suggest me in this regard. Jazak Allah

Unity is not so good share one has in their portfolio you can do trades in this script.29.50 is very heavy resistance area for unity. So it is at profit taking levels. And if break the resistance than 32.60 is next level.

PTL has massive sales and even there is chance it can give dividend as well. Its fundamentals are good, if you add more quantity from 38~ 36 rate your average price will be adjusted and hold have patience profit will come to you don’t rush the process. If it closes above 52 there is open room for PTL to reach 60 level.