Can Pakistan’s power sector light up portfolios?

Key takeaways:

- April 2025 power generation surged 22% YoY, the highest increase since April 2022

- Average generation cost held flat YoY at Rs. 8.95/kWh, but dropped 3% MoM

- Hydel contribution rose to 22%, reducing overall cost

- Coal and RLNG were the top contributors to the energy mix

- Furnace oil’s share dropped below 1%—reflecting a structural shift away from expensive fuels

A powerful comeback for Pakistan’s electricity output

Pakistan’s power sector just posted its strongest year-on-year growth in over two years. As per NEPRA’s data for April 2025, electricity generation clocked in at 10,513 GWh, reflecting a 22% YoY increase—a clear sign that demand is picking up after a prolonged period of stagnation.

On a month-on-month basis, power generation also rose by 25%, backed by seasonal summer demand, a shift of captive power plants (CPPs) to the national grid, and a drop in consumer tariffs. These factors, along with expectations of an industrial rebound, point to a favorable outlook for power producers and distributors.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Generation mix: cleaner and cheaper

Hydel, coal, RLNG, and nuclear plants were the major contributors this month:

| Source | Apr-25 Share | YoY Change |

|---|---|---|

| Coal | 25% | +186% |

| Hydel | 22% | +11% |

| RLNG | 21% | Flat |

| Nuclear | 18% | -8% |

| Gas | 8% | -14% |

| Furnace Oil | 1% | Minimal |

| Renewables (Wind/Solar/Bagasse) | ~6% total | Mixed |

This diversification, particularly the rise in hydel share to 22% from 15% in March, helped pull down the average generation cost to Rs. 8.95/kWh, a 3% MoM drop. This cost efficiency bodes well for the financials of generation companies and should support margin expansion in upcoming quarters.

Cost breakdown by source – April 2025

| Source | Cost (Rs/kWh) | MoM Change | Contribution to Total Cost |

|---|---|---|---|

| Hydel | 0.00 | 0% | 0.00 |

| Coal | 13.42 | -3% | 2.97 |

| RLNG | 24.26 | +5% | 4.49 |

| Nuclear | 2.10 | +5% | 0.34 |

| Gas | 11.81 | -1% | 0.85 |

| FO | 28.93 | +8% | 0.00 |

| Average | 8.95 | -3% | 8.95 |

What does it mean for investors?

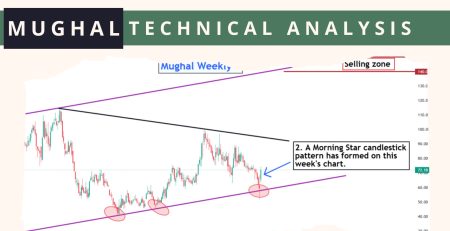

The shift in Pakistan’s energy mix toward cheaper and cleaner fuels like hydel and nuclear, combined with falling RLNG and gas costs, is setting the stage for improved sector profitability. Energy companies with a strong hydel or diversified generation portfolio stand to benefit most.

📢 Announcement: We're on WhatsApp – Join Us There!

The government’s effective move away from furnace oil (now under 1% of the mix) and the stabilizing generation costs may also provide a cushion to distribution companies (DISCOs), reducing circular debt risk.

With industrial demand expected to rebound and tariffs becoming more competitive, investors should keep a close eye on IPPs (Independent Power Producers) and other listed utilities in the coming quarters.

Source: JS Global

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply