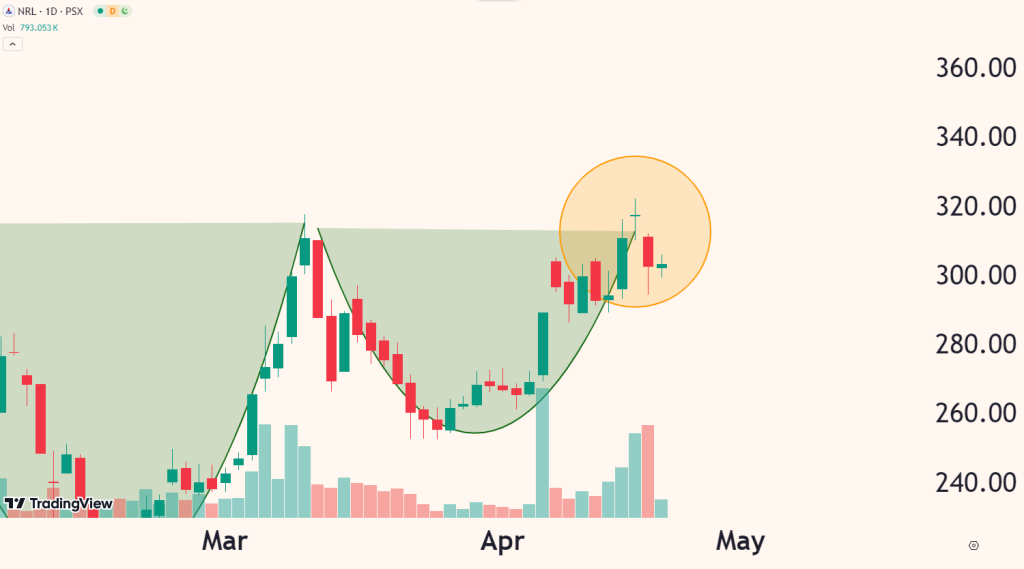

NRL – Cup & Handle failure forming reversal pattern

National Refinery Limited (NRL) has been forming a cup & handle pattern recently, poised for a breakout. It made an attempt at the breakout on 19th April, On this day, it formed a Doji candle, which is usually considered a neutral candlestick pattern.

Let’s conduct the NRL technical analysis in detail here. The initial breakout from the cup and handle pattern was interesting as it came on the back of increasing volumes. The volume reached its peak on the day of the breakout,

📢 Announcement: We're on WhatsApp – Join Us There!

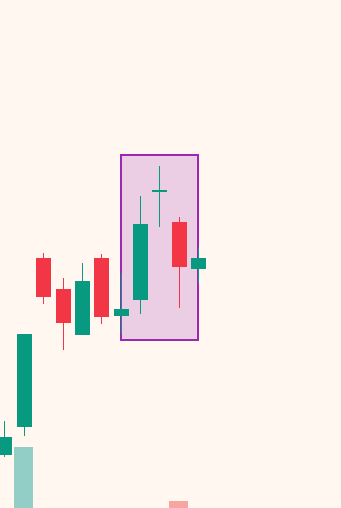

However, since then the chart has formed the Evening Doji Star candlestick pattern as shown below:

The evening doji star can be identified by the big green candle, followed by gap up opening forming a doji candle, with the body of the doji candle staying well above the previous day’s close. On the third day, the stock reverses, closing just below the 50% point of the first green candle. This is a typical formation of this pattern.

It is a rate candestick pattern. About 75% of the time, it shows reversal after an uptrend. If this is anything to go by, chartists would expect a bearish reversal in NRL from this point on.

This bearish reversal is also supported by divergence on the RSI(pink lines in the image below).

The NRL board meeting is scheduled for this Thursday and it will be interesting to see how the company reports its quarterly performance. In addition to that, the refinery policy news is also affecting the stocks in this sector.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply