5 Reasons Why MEBL Could Continue Rising Despite a Growth Slowdown

Meezan Bank (MEBL) has already delivered strong returns over the past cycle, and concerns are now emerging around slowing earnings growth. Even so, several factors suggest the stock could continue to perform well despite moderation in growth. Below are the key reasons investors are still constructive on MEBL, explained in simple terms.

Valuation Still Looks Reasonable Relative to Quality

Even after its rally, MEBL continues to trade at valuation levels that many investors consider reasonable given the bank’s profitability and balance sheet strength.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Compared to conventional banks, MEBL consistently delivers higher returns on equity. The market has historically been willing to pay a premium for this quality, and research commentary suggests that this premium is not yet stretched. As long as returns remain structurally higher, valuation support stays intact even if growth slows.

Deposit Growth Remains a Structural Advantage

One of MEBL’s biggest strengths is its ability to attract deposits at a faster pace than the industry.

Islamic banking penetration in Pakistan continues to rise, and Meezan remains the clear market leader. This structural trend does not disappear simply because overall banking growth slows. A strong and growing deposit base allows MEBL to maintain balance sheet expansion and protect margins better than peers.

Margin Stability Provides Earnings Cushion

📢 Announcement: We're on WhatsApp – Join Us There!

While earnings growth may slow, MEBL’s margins remain more resilient than those of many conventional banks.

The bank’s asset mix, pricing power, and focus on Shariah-compliant financing products help protect spreads. Even in a declining rate environment, this margin stability reduces downside risk to earnings and supports steady profitability.

Asset Quality Reduces Downside Risk

MEBL has historically maintained better asset quality compared to the broader banking sector.

Lower non-performing loans mean fewer surprises in the form of provisioning charges. This is especially important during periods of slower economic growth, when weaker banks tend to see profits come under pressure. Strong asset quality allows MEBL to defend earnings even when credit growth moderates.

Dividend Appeal Supports the Share Price

Dividend-paying stocks tend to perform better when growth becomes less exciting.

MEBL’s consistent dividend payouts provide a steady return component for investors. As interest rates ease and investors look for reliable income, dividend visibility becomes an important support for the stock price, even if capital appreciation slows.

Why Growth Slowing Does Not Mean the Story Is Over

A slowdown in growth does not automatically translate into weaker stock performance. In MEBL’s case, the investment case is increasingly about stability, quality, and predictability rather than rapid expansion.

As long as Meezan Bank continues to deliver strong returns, maintain asset quality, and reward shareholders with dividends, the stock can continue to rise gradually despite slower headline growth.

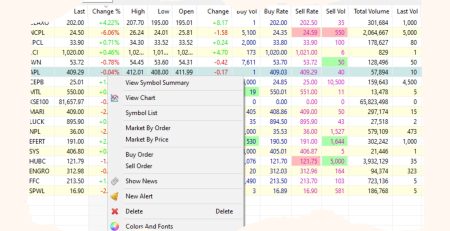

What Are Analysts Saying About MEBL Stock

According to the KSEStocks Database, MEBL is covered by 13 analysts in Pakistan and they have an average price rating of PKR 553. This average price target suggests an upside of 10.6% from the last close of PKR 500.21.

According to EPS estimates from 17 different brokers, MEBL has an average 2026 EPS expectation of 48.7. This suggests the stock is now trading at a forward PE of 10.4.

Why do we compile research firms’ forecasts? Broker research is fragmented across different houses. Compiling it in one place helps investors see consensus, identify divergence, and think independently rather than relying on a single view.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply