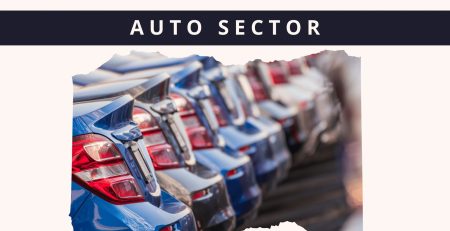

SUV May Sales to Improve – Which stocks will benefit?

Increase in overall car sales

The provisional auto sales figures for May 2024 reveal a mixed performance among Pakistan’s leading car assemblers. Overall, the sales of four major car manufacturers are estimated to have increased by 4% month-on-month (MoM) to 10,030 units.

Segment-wise performance

SUV Sales Surge

The SUV segment, comprising players associated with PAMA, saw a significant improvement. Estimated SUV sales increased by 18% MoM to 2,105 units. This rising demand for SUVs is attributed to better features, fuel economy, and value for money compared to sedans.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Sedan Sales Decline

In contrast, sedan sales experienced a substantial decline, dropping by 31% MoM to 1,978 units. This shift indicates a growing consumer preference for SUVs over sedans.

Company-specific trends

Pak Suzuki Motor Company (PSMC)

PSMC‘s sales remained flat at 6,015 units in May. Despite this stagnation, PSMC maintained its position as the market leader.

Honda Atlas Cars (HCAR)

HCAR reported a notable increase in sales, with 1,185 units sold in May, marking an 18% MoM rise. This growth was mainly driven by a significant increase in HR-V sales, which doubled compared to the previous month.

Indus Motors (INDU)

📢 Announcement: We're on WhatsApp – Join Us There!

Indus Motors saw a slight decline in sales, down by 1% MoM to 2,050 units in May. The decline in Corolla and Yaris sales was offset by the performance of the Corolla Cross SUV. INDU’s sales were impacted by plant shutdowns due to low inventory and parts shortages, effects of import restrictions that still linger.

Sazgar Engineering Works (SAZEW)

SAZEW experienced a significant boost in SUV sales, with units rising to 780, up 42% MoM. This surge led to an increase in Sazgar’s SUV market share to 37%, compared to 31% in the previous month.

Key Data

| Metric | Value |

|---|---|

| Sector | Automobile Assembler |

| Current Market Cap. | Rs 459 bn |

| Current Turnover | 17.9 mn sh |

| Current Traded Value | Rs 3.8 bn |

| 3m Avg. Market Cap. | Rs 446 bn |

| 3m Avg. Turnover | 17.0 mn sh |

| 3m Avg. Traded Value | Rs 2.9 bn |

| 6m Avg. Market Cap. | Rs 431 bn |

| 6m Avg. Turnover | 13.0 mn sh |

| 6m Avg. Traded Value | Rs 2.2 bn |

| 12m Avg. Market Cap. | Rs 431 bn |

| 12m Avg. Turnover | 13.0 mn sh |

| 12m Avg. Traded Value | Rs 2.2 bn |

Car Sales by Local Assemblers

| Units | 11MFY23A | 11MFY24E | YoYD% |

|---|---|---|---|

| PSMC | 62,354 | 47,548 | -24% |

| INDU | 29,258 | 17,816 | -39% |

| HCAR | 16,572 | 12,117 | -27% |

| SAZEW | 1,598 | 4,503 | 182% |

| TOTAL | 109,782 | 81,984 | -25% |

SUV Sales by Local Assemblers

| Units | MAY24E | YoYD% | MoMD% |

|---|---|---|---|

| Corolla Cross | 804 | NM | 0% |

| Hyundai Tucson | 298 | -5% | 18% |

| Hyundai Santa Fe | 143 | NM | 2% |

| Honda HR-V | 80 | NM | 100% |

| Haval + BAIC | 780 | NM | 42% |

| Total | 2,105 | NM | 18% |

Sedan Sales by Local Assemblers

| Units | MAY24E | YoYD% | MoMD% |

|---|---|---|---|

| Civic + City | 1,049 | NM | 10% |

| Corolla + Yaris | 758 | -11% | -56% |

| Sonata + Elantra | 171 | -16% | -17% |

| Total | 1,978 | 78% | -31% |

Disclaimer:

The information in this article is based on research by JS Research. All efforts have been made to ensure the data represented in this article is as per the research report. This report should not be considered investment advice. Readers are encouraged to consult a qualified financial advisor before making any investment decisions.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply