Pak Datacom’s new revenue engines are online: should you pay attention?

Key takeaways

- Net profit for 9MFY25 edged up to PKR 110 million

- Revenue surged 112 percent year over year in 3QFY25

- Company maintains 30 to 35 percent share in the VSAT market

- Strategic partnerships with Kacific and British Telecom open new growth avenues

- Revenue per employee has nearly tripled since CY20

- Starlink distribution talks and in-building connectivity solutions could further strengthen future earnings

Financial performance: revenue growth outpaces costs

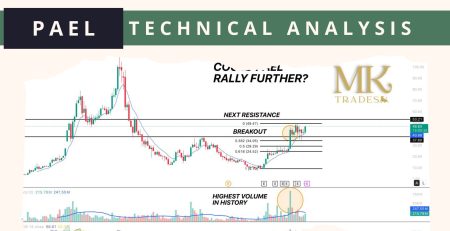

Pak Datacom (PAKD) reported a net profit of PKR 110 million for the nine months ending March 2025. While profit growth was modest at just 2 percent year over year, the third quarter alone saw a sharp turnaround. Revenue in 3QFY25 doubled compared to the same period last year, rising to PKR 623 million from PKR 295 million. This revenue spike resulted from the monetization of new business lines that had been ramping up since the start of the fiscal year.

Although costs also climbed, with cost of sales increasing by 125 percent year over year in the latest quarter, the company still posted a significant increase in quarterly profit before tax, which rose to nearly PKR 100 million.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

VSAT market leadership and new frontiers

Pak Datacom remains a key player in Pakistan’s telecom space, with an estimated 30 to 35 percent market share in the VSAT segment. The company has deep-rooted relationships with government and enterprise clients, including the military, NADRA, and major oil firms.

Pak Datacom is now positioning itself for the next phase of growth by entering the high-speed satellite internet market through a partnership with Kacific. Kacific offers affordable satellite internet in remote areas and currently operates without the regulatory constraints facing Starlink. Talks are ongoing for potential Starlink distribution as well.

New business ventures and technology deployments

In addition to satellite internet, the company is testing in-building antennas and small-cell technology to improve indoor connectivity, an issue that plagues many offices and government premises in Pakistan. The company is also engaging in hybrid service models and has initiated a feasibility study to assess its long-term viability.

📢 Announcement: We're on WhatsApp – Join Us There!

Pak Datacom has also taken steps to future-proof its revenue. Contracts with banks have zero switching costs and span multiple years, ensuring stable cash flows.

Operating efficiency and profitability trends

Revenue per employee has risen from PKR 3.4 million in 2020 to PKR 9.3 million in CY24, showing enhanced productivity and efficiency. Despite currency fluctuations impacting profitability in FY24, the long-term outlook remains stable thanks to a positive exchange rate environment and disciplined cost management.

Gross margin did decline in 3QFY25 due to rising costs, but management remains optimistic that new lines of business will improve overall profitability in the long run.

Growth outlook: Pakistan and beyond

While global telecom growth is expected to slow to 1.6 percent in 2025, Pakistan’s telecom market is forecasted to expand by 7 percent over the next five years. Pak Datacom has outpaced both with a compound annual growth rate of 23 percent over the last three years. Management aims to sustain this by focusing on international expansion, solar energy integration, and digital transformation.

A quiet performer with room to surprise

Pak Datacom may not make headlines every day, but its fundamentals are solid. With legacy government clients, expanding product lines, and partnerships with global telecom firms, the company is quietly building a diversified revenue stream that positions it well for the future.

The introduction of satellite broadband, enhanced indoor connectivity solutions, and strategic expansion all point to steady long-term gains for patient investors.

Source: Chase Securities

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply