HUBC HY2024 Corporate Briefing

The Hub Power Company Limited (HUBC) held its corporate briefing for HY2024 results on 20/02/2024.

I will dive into the details of the briefing. Let’s begin.

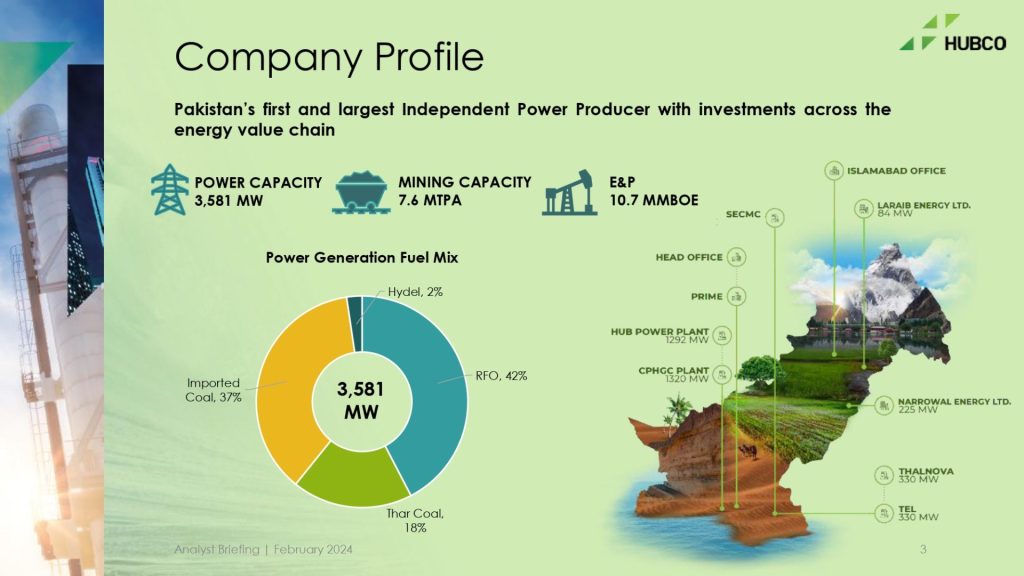

HUBC Profile

The Hub Power Company (HUBC) is the first and largest IPP in Pakistan.

📢 Announcement: We're on WhatsApp – Join Us There!

As of December 2023, its power generation capacity stands at 3581 MW. On top of that, it also boasts a mining capacity of 7.6mn tons per annum and E&P of 10.7MMBOE.

Its power generation mix is as follows:

- RFO: 42%

- Imported Coal: 37%

- Thar Coal: 18%

- Hydel: 2%

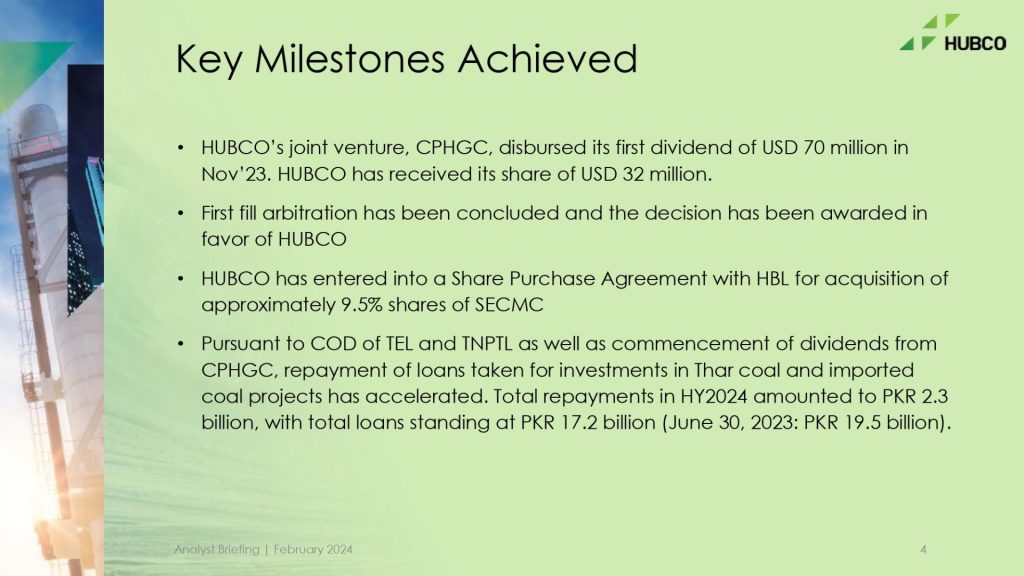

Key milestones achieved in HY2024

CPHGC disbursed its first dividend of $70mn in November 2023

HUBCO’s joint venture CPHGC disbursed its first dividend of $70mn in November 2023.

Don't miss:

- Which cars are driving the rally in auto stocks?

- 5 High ROE stocks according to Topline Securities

- Why TPLP could go higher.

Since HUBC has a 46% equity stake in CPHGC, it received $32mn of that amount.

Going forward, the company expects to receive CPHGC dividends on a more consistent basis.

First fill arbitration decision awarded in favor of HUBC

The first bill arbitration process has concluded and the company will receive Rs. 11.5bn once the court order has been received and other formalities completed.

This will not have any impact on the EPS but will add to the company’s cash flows.

HUBC acquiring another 9.5% stake in SECMC

It was recently announced that HUBC was acquiring a 9.5% stake in SECMC.

The company already holds an 8% stake in the Singh Engro Coal Mining Corproation (SECMC). It will buy another 9.5% stake after acquiring the share currently held by Habib Bank Limited (HBL).

This acquisition will take HUBC’s total stake in SECMC to 17.5%, making it the second-largest stakeholder in the project.

The company will finance the acquisition through internal cash generation. It did not disclose the price of the acquisition as the matter was still waiting for some corporate as well as regulatory approvals.

Repayment of loans

The company plans to repay the loans it took for the establishment of Thar coal and imported coal projects. The capacity to repay these loans is boosted by dividends from CPHGC and COD of TEL and TNPTL.

Total repayment in HY2024 amounted to Rs. 2.3bn with loans standing at Rs. 17.2bn.

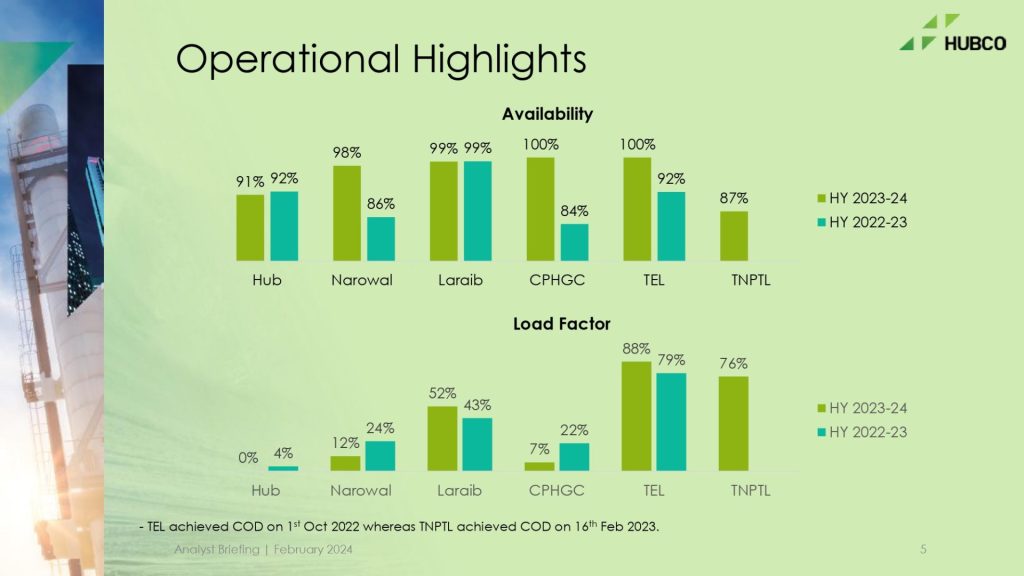

Operational highlights

1HFY24 plat-wise availability

1HFY24 plat-wise availability was as follows:

| Plant | 1HFY24 | 1HFY23 |

| Hub | 91% | 92% |

| Narowal | 98% | 86% |

| Laraib | 99% | 99% |

| CPHGC | 100% | 84% |

| TEL | 100% | 92% |

| TNPTL | 87% | – |

Since the company’s profitability mainly depends on availability, it did a good job of maintaining the availability close to 100% for all its plants.

1HFY24 plant-wise load factor

1HFY24 plant-wise load factor was as follows:

| Plant | 1HFY24 | 1HFY23 |

| Hub | 0% | 4% |

| Narowal | 12% | 24% |

| Laraib | 52% | 43% |

| CPHGC | 7% | 22% |

| TEL | 88% | 79% |

| TNPTL | 76% | – |

The load factors for TEL and TNPTL were high as they are Thar coal based projects and generate cheaper electricity, which takes them to a higher position on the merit order.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply