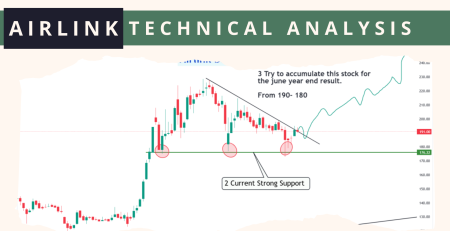

Can Airlink’s Xiaomi exports turn it into Pakistan’s global tech star?

Airlink Communication Ltd. (AIRLINK) is poised to tap into a high-potential growth stream: Xiaomi smartphone exports. This strategic move marks a significant shift for the company, signaling not just a return to the international arena but a bolder, more calculated leap toward long-term revenue diversification and global relevance.

Why does Xiaomi’s export matter?

Xiaomi currently ranks as the third largest smartphone brand globally, trailing only Samsung and Apple. With the majority of shipments exported from China and the U.S. leading in imports, Xiaomi’s reputation for quality and affordability gives it a global edge. Tapping into this brand’s global pull presents a high-upside opportunity for Airlink, which manufactures Xiaomi phones in Pakistan.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Previously, Airlink had paused exports due to policy instability and currency volatility. But recent improvements in Pakistan’s economic landscape and trade policies have prompted the company to resume exports, a decision that’s aligned with the global appetite for mid-range, high-quality smartphones.

Capacity to scale

Airlink’s current utilization rate stands at only 26%, indicating it has significant production bandwidth ready to be activated. This under-utilized capacity allows Airlink to scale exports efficiently without major new investments. According to estimates, Airlink aims to export 300,000 Xiaomi smartphones in FY26, making it one of the first local manufacturers to push exports at this scale.

Strategic impact

This export initiative offers multiple benefits:

- Revenue diversification beyond Pakistan’s volatile domestic market.

- Global brand alignment through Xiaomi’s strong recognition.

- Improved capacity utilization, boosting operational efficiency.

- Enhanced investor sentiment, signaling confidence in the company’s long-term strategy.

📢 Announcement: We're on WhatsApp – Join Us There!

This move could also act as a precedent for other Pakistani firms looking to enter export markets through joint manufacturing or licensing with global tech brands.

Investor Takeaway: With Xiaomi’s global reputation and Airlink’s existing infrastructure, the export push could unlock a high-growth chapter for the company. As international demand for budget-friendly smartphones grows, Airlink is strategically positioned to meet that demand while enhancing shareholder value.

Source: Foundation Securities

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply