Can DGKC Reach PKR 400 per share?

DG Khan Cement (DGKC) has once again come into focus after AKD Securities assigned a target price of PKR 389 per share. This has naturally raised a simple question for investors: can DGKC realistically cross the PKR 400 mark?

To answer that, we break down the bullish case, key triggers, catalysts, and the risks in plain, easy-to-understand terms.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Why DGKC Is Back on Investors’ Radar

DGKC is one of Pakistan’s largest cement manufacturers and is closely linked to economic activity. When construction picks up, DGKC usually benefits. With interest rates falling and demand slowly improving, the backdrop is becoming supportive again.

The Bullish Thesis for DGKC

Demand Recovery Is the Core Story

Cement demand in Pakistan had been under pressure due to high interest rates and weak construction activity. This is now changing.

Lower policy rates make home construction, infrastructure projects, and private development more affordable. As borrowing costs come down, cement demand typically recovers with a lag, and DGKC is well positioned to benefit.

Falling Interest Rates Help the Bottom Line

📢 Announcement: We're on WhatsApp – Join Us There!

DGKC carries meaningful debt. In simple terms, this means interest costs matter a lot for profitability.

As interest rates decline:

- Finance costs reduce

- Net profits improve

- Cash flows become healthier

This alone can significantly lift earnings without needing a massive jump in sales volumes.

Better Pricing Discipline in the Cement Sector

Over the last year, cement companies have shown better discipline on prices, especially in the North region.

Instead of aggressive price wars:

- Companies are focusing on protecting margins

- Price cuts are more controlled

- Any increase in demand directly improves profitability

This is a positive structural shift for DGKC.

Export Optionality Adds Support

While local demand remains the key driver, DGKC’s ability to export provides downside protection.

If domestic conditions soften:

- Exports help absorb excess capacity

- Foreign currency revenues support cash flows

This optionality improves overall business stability.

What Can Push DGKC Toward PKR 400?

Key Triggers to Watch

Faster-than-Expected Rate Cuts

If interest rates fall quicker than expected, DGKC’s earnings could surprise on the upside.

Strong Cement Dispatch Numbers

Monthly dispatch data showing consistent growth would strengthen confidence in the recovery story.

Infrastructure Spending

Any acceleration in government infrastructure projects directly boosts cement demand.

Earnings Re-Rating

If profits improve visibly, the market may be willing to assign DGKC a higher valuation multiple.

Risks Investors Should Not Ignore

Demand Recovery Could Be Slower

If construction activity does not pick up meaningfully, volumes may disappoint.

Energy Costs Volatility

Coal and power costs remain key risks. Any sharp increase can offset the benefit of lower interest rates.

So, Can DGKC Reach PKR 400?

DGKC reaching PKR 400 per share is possible, but it is not automatic.

PKR 389, as suggested by AKD, looks achievable under current assumptions. PKR 400 and above would require stronger execution, faster easing, and sustained demand recovery.

For long-term investors, DGKC offers a classic cyclical recovery story. The upside is real, but patience and risk awareness remain essential.

As always, cement stocks reward investors when the cycle turns, and DGKC appears to be entering that phase.

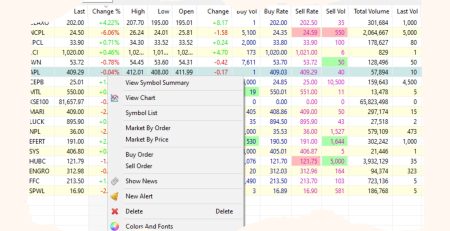

What Are Other Analysts Saying About DGKC Stock?

According to the KSEStocks Database, DGKC is covered by 15 analysts in Pakistan and they have an average price rating of PKR 322. This average price target suggests an upside of 41.2% from the last close of PKR 227.86.

According to EPS estimates from 17 different brokers, DGKC has an average 2026 EPS expectation of 24.4. This suggests the stock is now trading at a forward PE of 9.5.

Why do we compile research firms’ forecasts? Broker research is fragmented across different houses. Compiling it in one place helps investors see consensus, identify divergence, and think independently rather than relying on a single view.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply