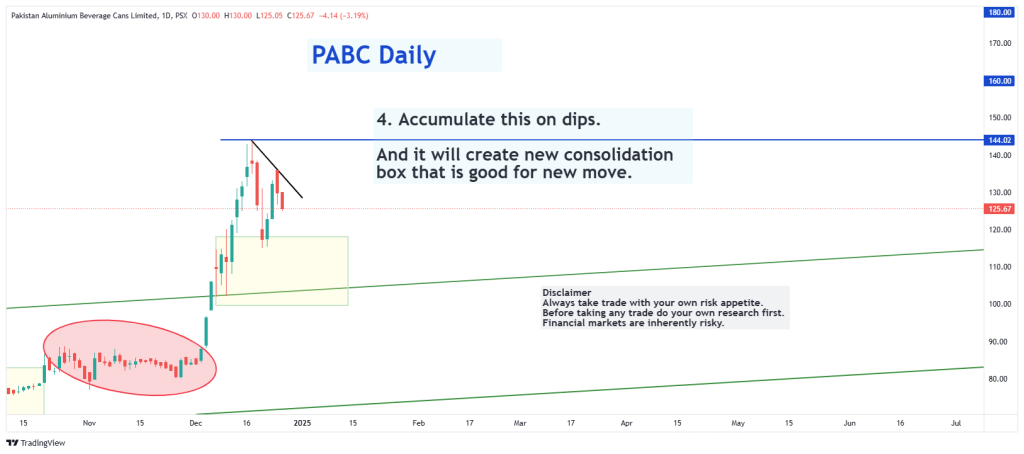

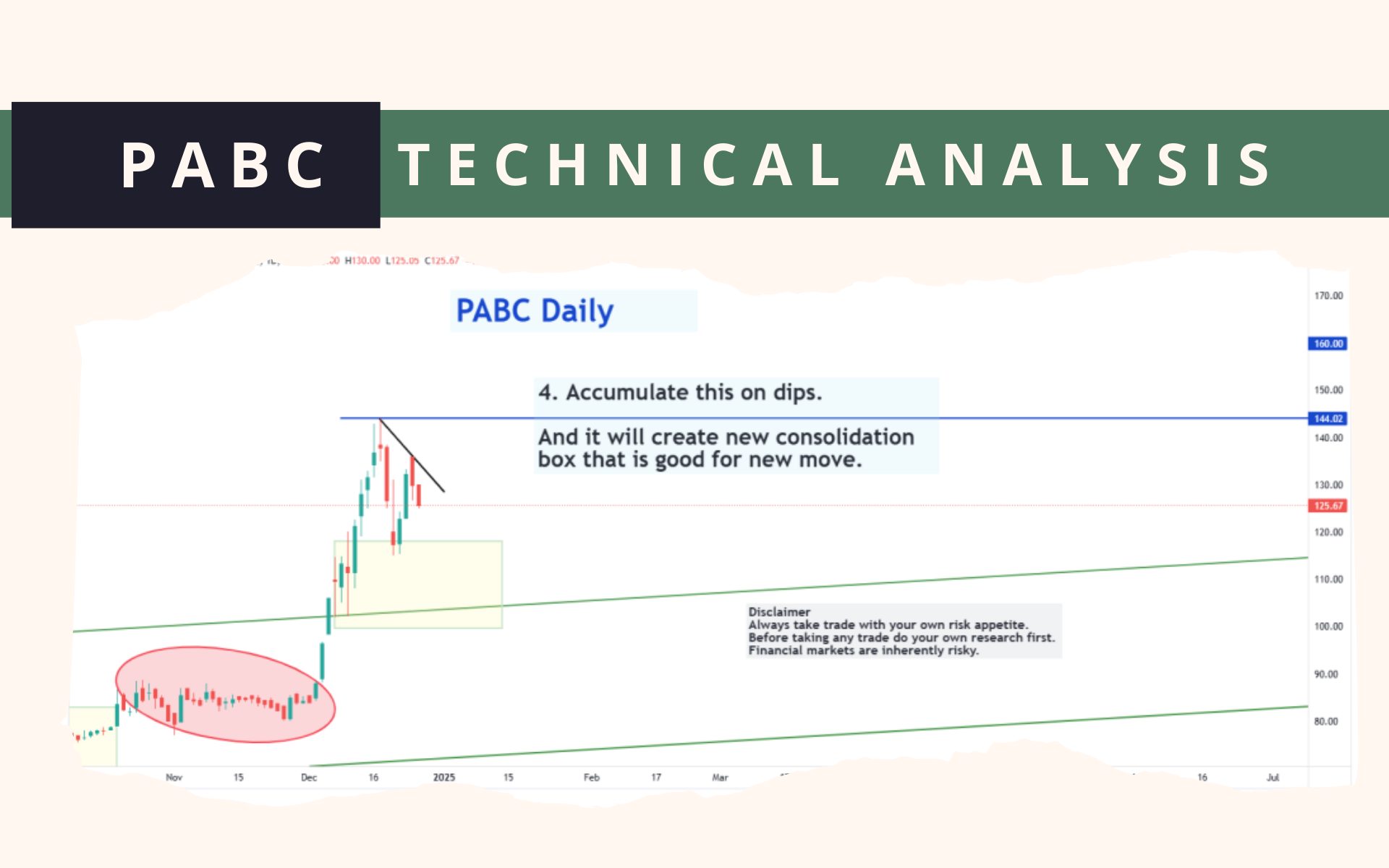

PABC’s long-term opportunity

Pakistan Aluminium Beverage Can Limited (PABC) is printing Higher high and higher low market structure in monthly time frame.

PABC is about to create a new consolidation box in this year’s end to ride the uptrend from next year.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

It is a good time to focus on this stock and accumulating zones are 119 -113 – 104.

In daily time frame 144 is current resistance area. Closing above 145 would lead towards 160 – 180.

Always secure your hard earn profits.

📢 Announcement: We're on WhatsApp – Join Us There!

Sell 15% on every upside move, near short resistances are 127 – 135

Trend change would be if stock closes below 92 on Daily closing base

Ultimate Target 200.

Don’t forget it is also dividend oriented scrip.

“Long-term target prices take a long time to achieve.”

For more queries you can contact me on my instagram page Simplemarket11

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comment (1)

A very good technical analysis.