Nishat Mills: Attractive Valuation for Investor Interest

Nishat Mills LImited (NML) is slow and steady horse in Pakistan Stock market (PSX).

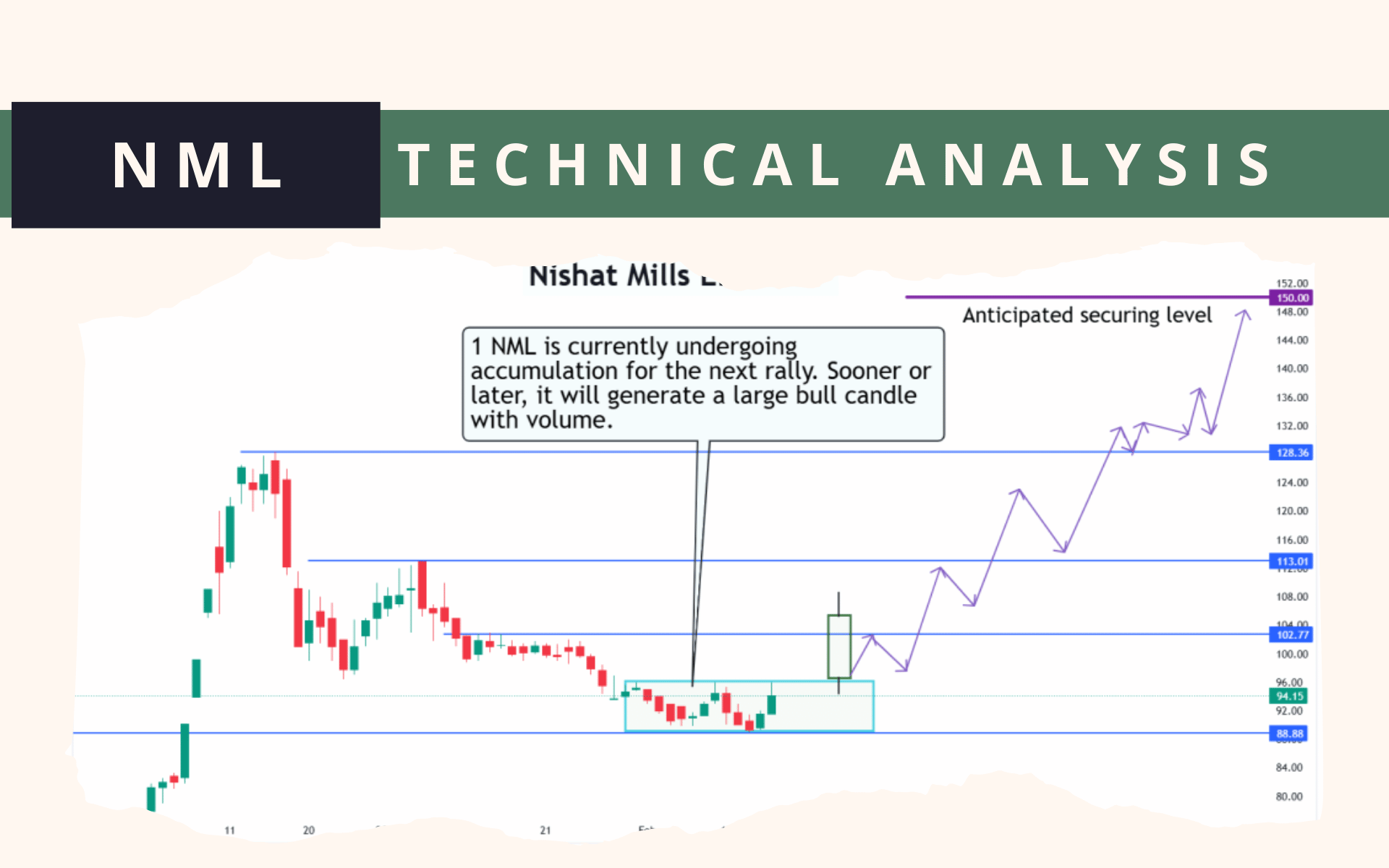

One can Accumulate it between the 90-88 level. In rare cases, it may even dip to the 80 level, but don’t be afraid

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

If it closes below 73 level then trend would change.

Currently, 103 is acting as a minor resistance. If it crosses this level, the stock will likely retest the previous resistance level at 113

For short-term investors, the profit-taking range is between 125 and 128.

📢 Announcement: We're on WhatsApp – Join Us There!

For long-term investors, 145 to 150 would be a good area to secure positions

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Comment (1)

Good advice, stock is fundamentally good and also right time to invest, thanks for your analysis and support is much appreciated.