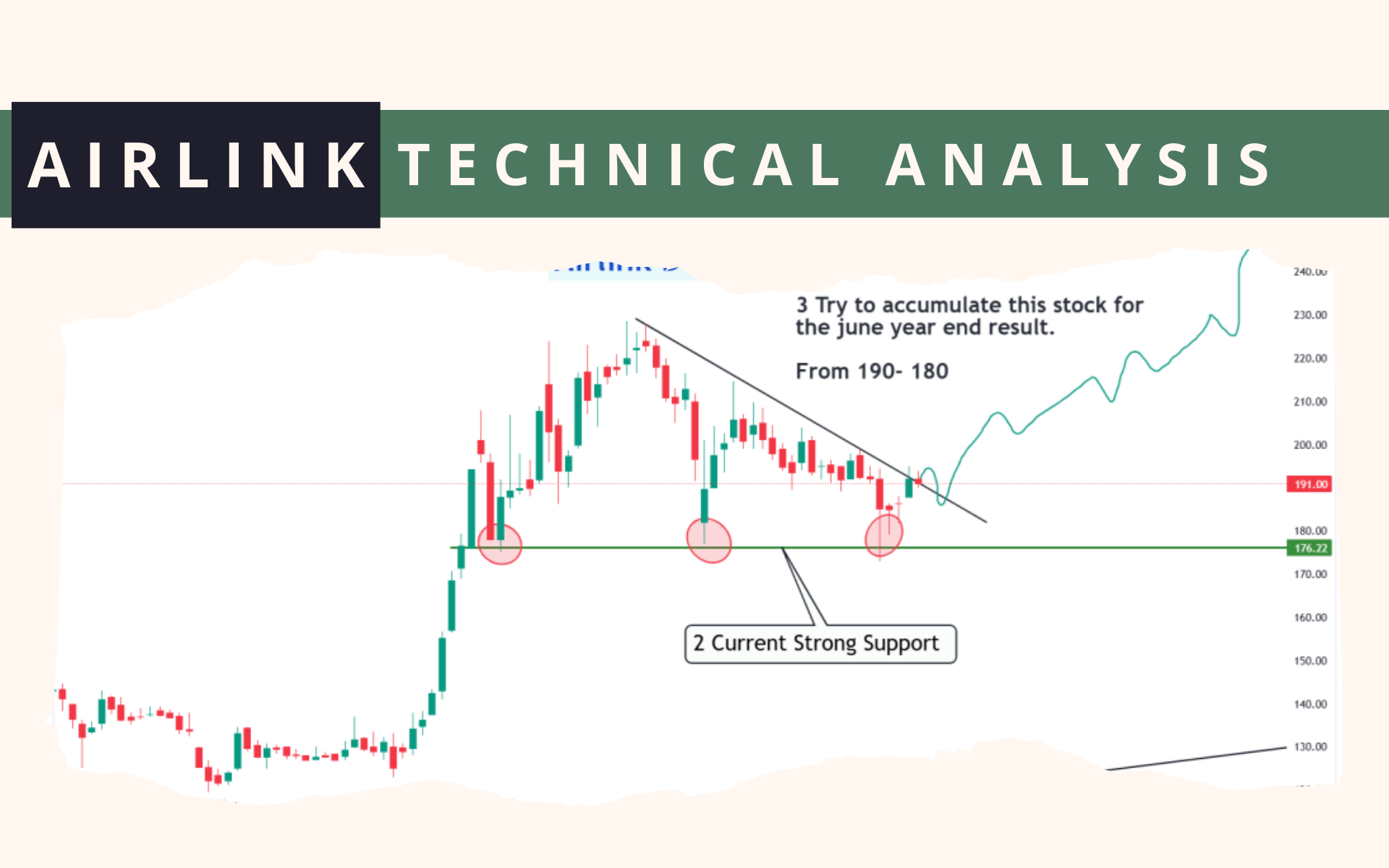

Airlink: Driving the tech sector forward

Since the beginning, Airlink stock has been generating bullish movements.

On a weekly time frame, the Airlink market structure is still intact making higher highs and higher lows.

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

In Daily, this is little range for investors and swing players.

Accumulate from 190- 180

Trend change would be if the stock closes below 155 in the daily time frame.

📢 Announcement: We're on WhatsApp – Join Us There!

For the save side, you can use the sell half, and hold half strategy.

In the short run securing areas 215- 227 and for long-term players 260-284

Disclaimer

Always take the trade with your own risk appetite.

Before taking any trade do your own research first.

Financial markets are inherently risky.

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply