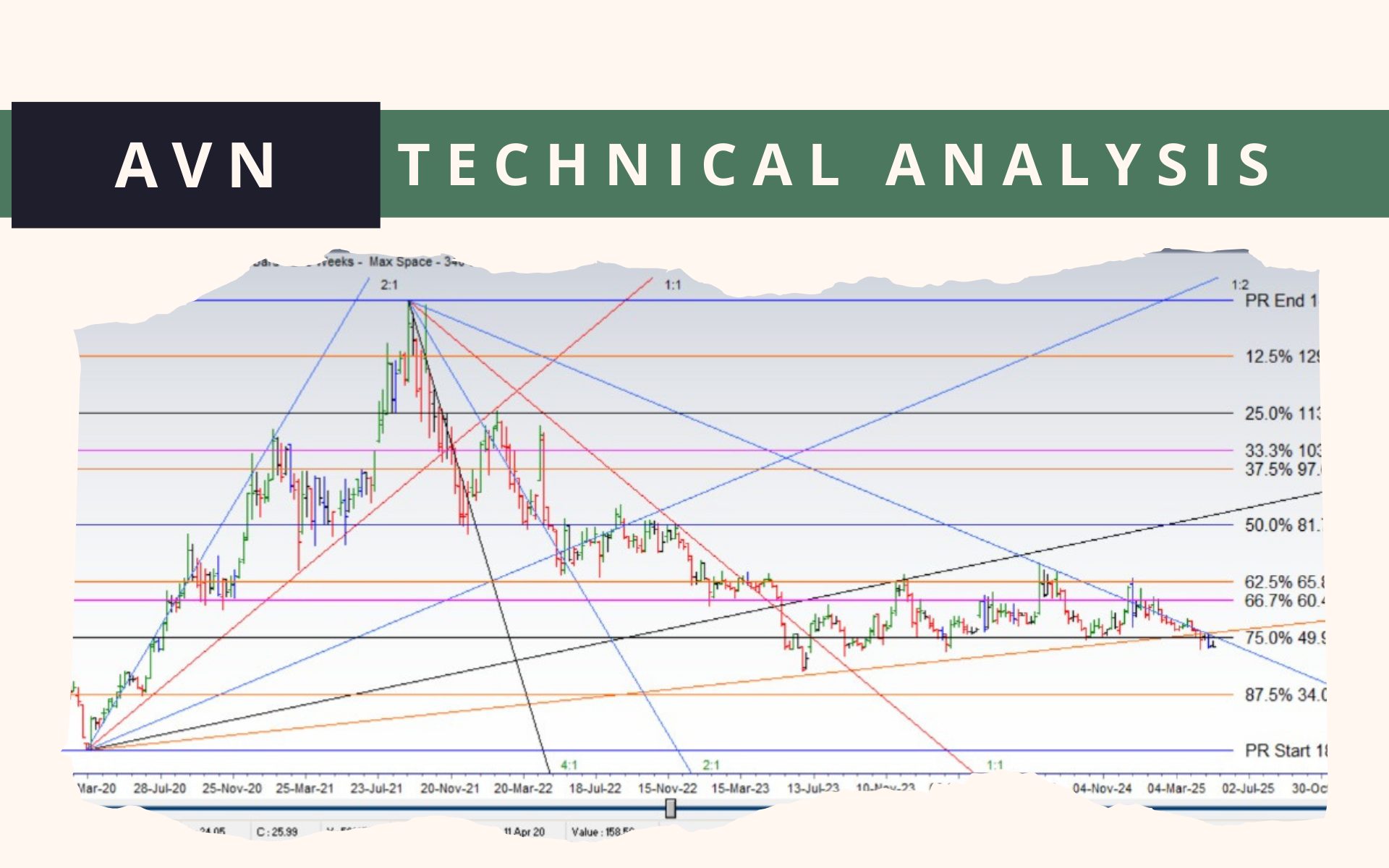

AVN Technical Analysis

AVN price range 127.3, Low March 2020 18.10

High September 2021 145.40

(145.40-18.10=127.3)

📢 Announcement: You can now access our services and similar analyses by opening an account with us via JS Global

Weekly chart shows sideways price movement from 1:1 to 1:2 angle, reflecting improvement in rate of decline from the high of 145.40

Key support Areas are 75%, 49.92% and 87.5%, and 34.01% of this range

Closing above a 1:8 Angle from the low of 18.10 and a 1:2 angle from the 145.40 high will indicate a reversal in trend.

Financial Performance (FY 2024)

- Revenue: PKR 16.16 billion (YoY decline of 9.07%)

- Net Profit Margin: 14.69%

- Gross Profit Margin: 31.27%

- Return on Equity (ROE): 19.94%

- Return on Assets (ROA): 10.06%

- Book Value Per Share: PKR 35.11

- Price-to-Book (P/B) Ratio: 1.35x

- Price-to-Sales (P/S) Ratio: 1.12x

Key Financial Ratios

- Current Ratio: 1.61 (indicates adequate short-term liquidity)

- Enterprise Value to EBITDA (EV/EBITDA): 5.74x

- Earnings Per Share (EPS): PKR 4.95

📢 Announcement: We're on WhatsApp – Join Us There!

⚠️ This post reflects the author’s personal opinion and is for informational purposes only. It does not constitute financial advice. Investing involves risk and should be done independently. Read full disclaimer →

Leave a Reply